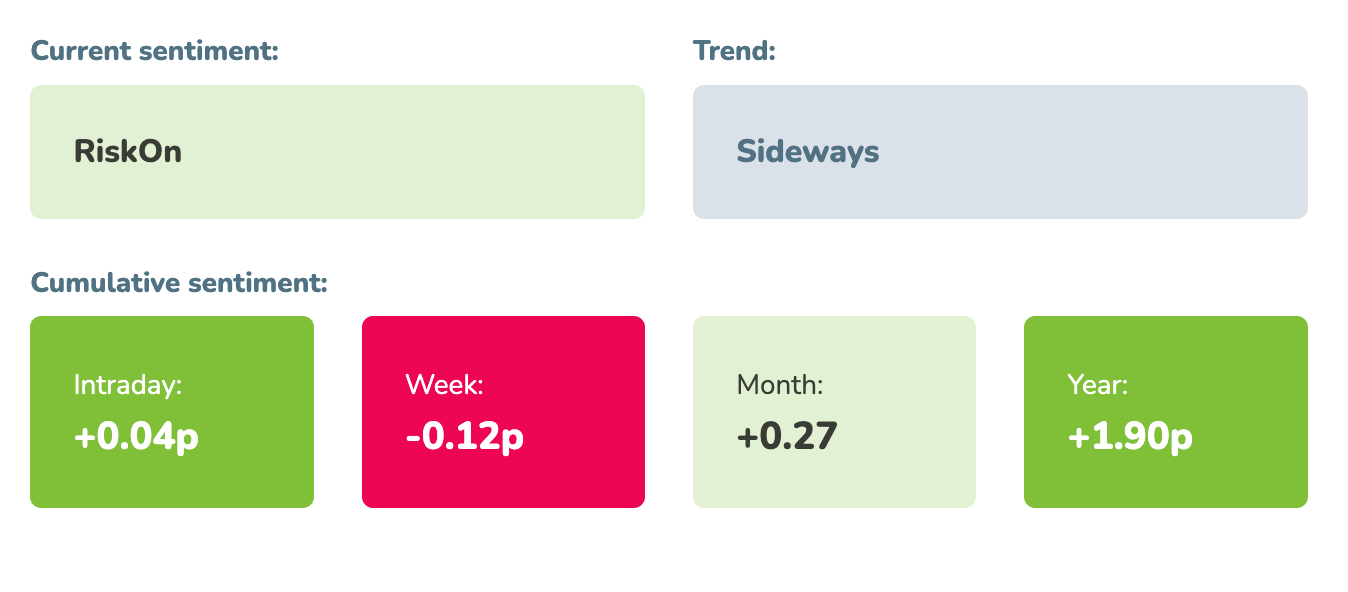

Market sentiment: RiskOn – 38 days

Recap of the past week:

The past week was all about anticipation for the new CPI figures. They turned out well. Actually, very well. However, it seemed the market was spooked by the inflation trend, leading to a negative turn. From our measurement perspective, it felt like a classic “Buy The Rumors, Sell The News” scenario. Nonetheless, on Friday, after the not-so-great US PPI, further decline in the Michigan Sentiment Index, and a drop in inflation expectations, the market rallied back towards its all-time highs. Considering the heavy representation of tech in the S&P 500, part of the market’s jitters can be attributed to the upcoming earnings season. Banks kicked off on Friday, and the market received the numbers with lukewarm enthusiasm. But in the end the market sentiment indicator remained in the positive RiskOn territory.

Outlook for the following week:

The upcoming week will be pretty likely heavily influenced by the attempted assassination of former President Trump. Since this event occurred over the weekend, the market will have time to digest it. We can expect Monday’s open to be under pressure. However, as time goes on, emotions should settle, and it’s likely the markets won’t be significantly impacted unless the situation escalates (e.g., through aggressive statements by prominent Republicans or Trump himself). Let’s take a look at the economic calendar.

On Monday, we have data from China (GDP, Industrial Production, Retail Sales) and the NY Empire State Manufacturing Index, along with the continuation of big bank earnings.

Tuesday focuses on the European ZEW (Germany and EU), Canadian inflation, and US Retail Sales (June). Before the US market opens, we’ll get more big bank earnings.

Wednesday brings inflation figures from New Zealand, the UK, and the EU. In the US, we’ll see Building Permits, Housing Starts, Industrial Production, and the Fed’s Beige Book. During the day, we get the first tech earnings, specifically from ASML Holding N.V.

Thursday, the main macro day of the week, starts with Australian and UK labor market data. In the afternoon, we have the ECB rate decision (expected to remain unchanged), the weekly US labor market report, and the Philadelphia Fed Manufacturing Survey (July). We can also look forward to the first AI earnings, particularly from Taiwan Semiconductor Manufacturing Company Limited, and after the close, streaming giant Netflix, Inc.

Friday’s calendar is relatively empty. The highlights are UK and Canadian Retail Sales and afternoon comments from Fed members Williams and Bostic.

Long-term sentiment

The current Moodix RiskOn sentiment is under pressure (see more on waves statistics) but still holding strong, now stretching to 38 days. The attempted assassination of Trump could cause initial nervousness (with the potential for a deeper correction if the situation escalates), but the market’s primary focus will be on the ongoing earnings season. Moodix trading systems will continue to seek out long trades.

Good luck! Team moodix!