We measure breaking news

and determine

market sentiment

We determine global market sentiment directly from market-relevant news and data that has verifiably impacted financial markets.

We measure breaking news and determine

market sentiment

We determine global market sentiment directly from market-relevant news and data that has verifiably impacted financial markets.

Gain insight into the financial markets.

Use the unique

moodix market sentiment indicator.

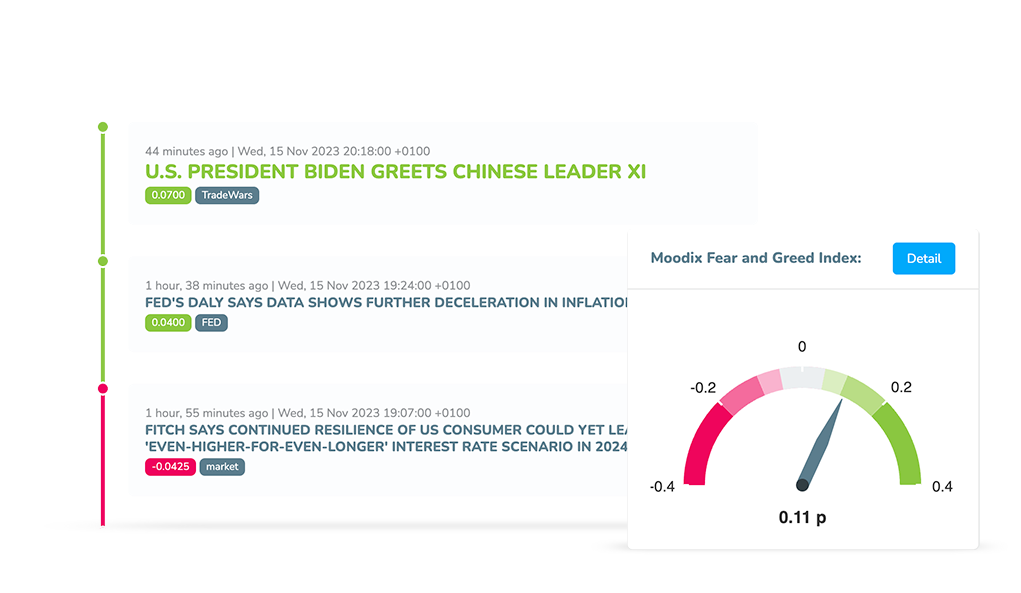

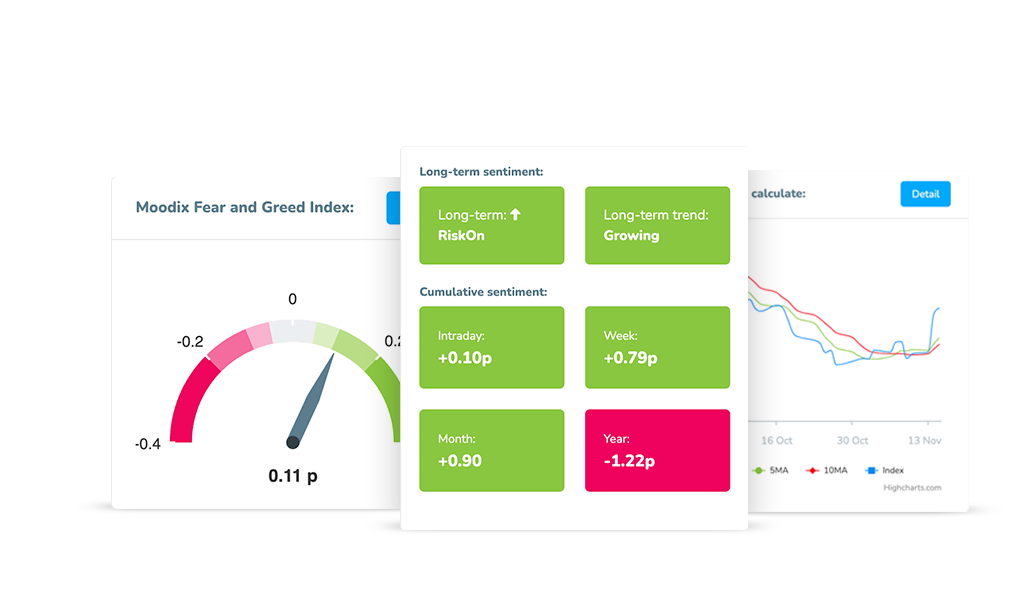

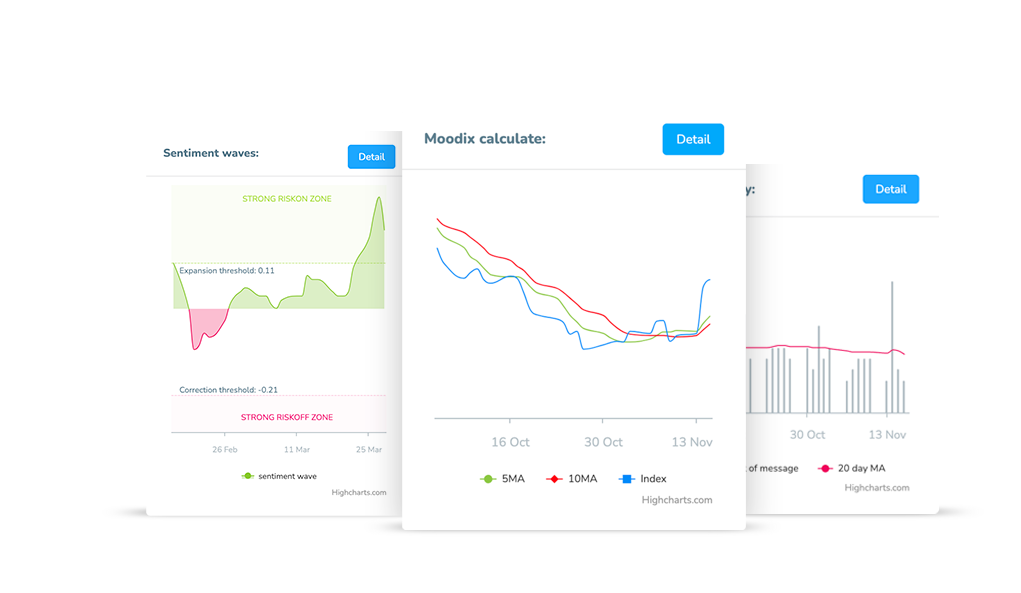

An overview of the main features of the moodix web app that makes life of all those involved in the financial markets much easier:

Navigate the market instantly.

Get what you need.

Right here. Right now.

Do you want to know the biggest breaking news of the week? What about long-term, week or intraday market sentiment? The direction of the trend?

Monitor changes and developments of market sentiment in real time.

With just a few simple indicators.

The desire to describe market sentiment in a few numerical values which is easy to interpret led us to develop a unique approach to measure the impact of fundament on the market itself and construct an indicator on top of it. Empirically. Simply. Ready to use.

Manage risk with ease in a known market environment.

Market threats and opportunities. Sorted. Visualized.

What are main market catalysts at the moment? What has scared or delighted the market recently? And what might likely be the positive impulse of growth today or next week? Is it a good idea to trade now at all? Here you go the answers.

Save your time and energy. Fundamentally.

We gained the insight. Infuse it and use it within your own vision.

A fair fundamental analysis and navigating through tons of headlines might be both challenging and time consuming. As it is our passion you can invest your energy and time elsewhere.

Latest news from moodix

Trump Assassination Attempt, Key Economic Data, Tech and Bank Earnings, ECB Decision, AI and Netflix in Focus (July 15 to July 19)

Market sentiment: RiskOn - 38 days Recap of the past week: The past week was all about anticipation for the new CPI figures. They turned out well. Actually, very well. However, it seemed the market was spooked by the inflation trend, leading to a negative turn. From...

Positive Sentiment Continues Amid Key US and China Data Releases (July 8 to July 12)

Market sentiment: RiskOn - 31 days Recap of the past week: Last week, influenced by US holidays and the start of the vacation season, market sentiment indicator continued on the wave of positive RiskOn sentiment, with the S&P 500 adding +1.5%. The market was...

Next Week’s Outlook: Key NFP Report and Sustaining RiskOn Sentiment (July 1 to July 5)

Market sentiment: RiskOn - 24 days Recap of the past week: The past week was primarily about waiting for Friday's data releases. We received the PCE index (slight decline as expected), the Michigan Sentiment Index, and the Chicago PMI. The SP500 index ended almost...

- Watch live sentiment measurement on X

Continue reading to learn how moodix works, how you can use moodix in your trading, or how to integrate moodix data into your trading systems via API.

How moodix works?

The moodix measurement is based on the thesis that most major market movements and trend changes in financial markets are the result of the impact of some of the endless stream of (more or less) chaotically emerging news. So-called "breaking news". This news, in aggregate, create positive or negative pressure and defines the sentiment of global financial markets.

How to use moodix sentiment?

Thanks to moodix measurements, we identify the mood and trend of the markets precisely. We time the market! See how you can implement the measurement into your own trading.

moodix API

If you run your own algo systems or have your own trading platforms, you can get up-to-date sentiment status using API connections. According to the above, you can create custom decision trees and implement moodix API into your systems.