We measure breaking news

and determine

market sentiment

We determine global market sentiment directly from market-relevant news and data that has verifiably impacted financial markets.

We measure breaking news and determine

market sentiment

We determine global market sentiment directly from market-relevant news and data that has verifiably impacted financial markets.

Gain insight into the financial markets.

Use the unique

moodix market sentiment indicator.

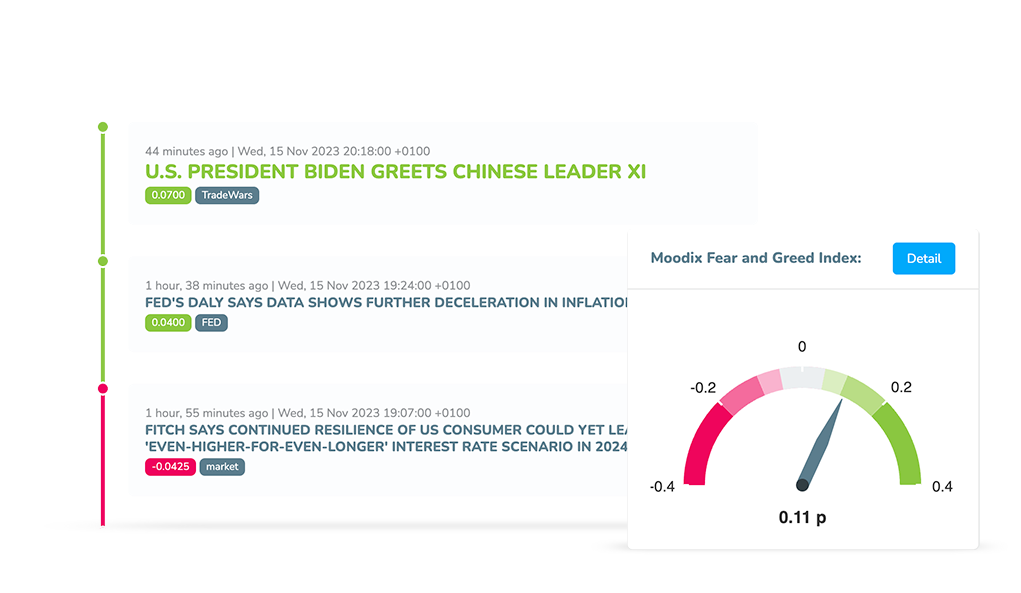

An overview of the main features of the moodix web app that makes life of all those involved in the financial markets much easier:

Navigate the market instantly.

Get what you need.

Right here. Right now.

Do you want to know the biggest breaking news of the week? What about long-term, week or intraday market sentiment? The direction of the trend?

Monitor changes and developments of market sentiment in real time.

With just a few simple indicators.

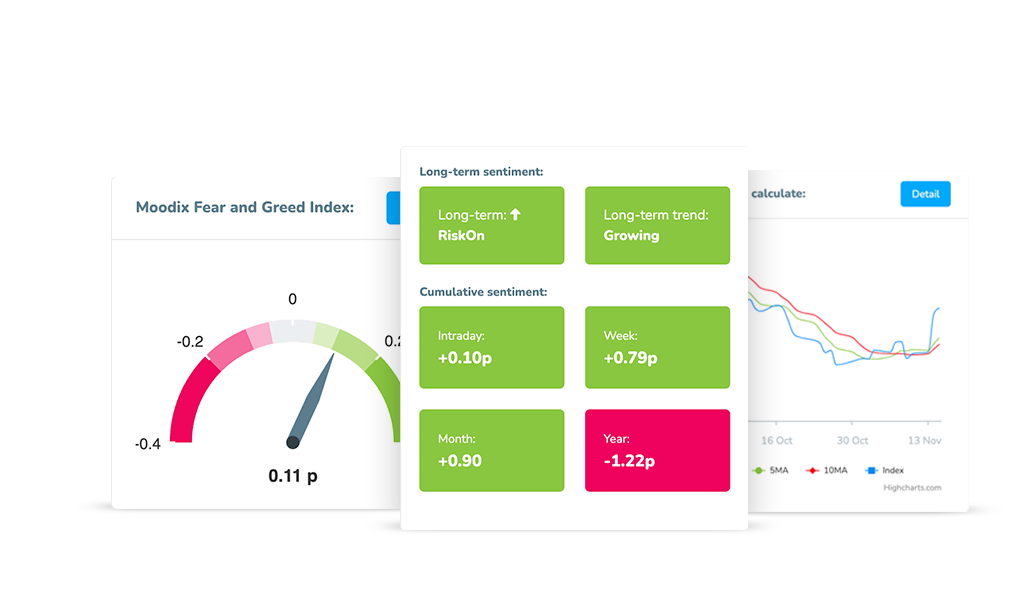

The desire to describe market sentiment in a few numerical values which is easy to interpret led us to develop a unique approach to measure the impact of fundament on the market itself and construct an indicator on top of it. Empirically. Simply. Ready to use.

Manage risk with ease in a known market environment.

Market threats and opportunities. Sorted. Visualized.

What are main market catalysts at the moment? What has scared or delighted the market recently? And what might likely be the positive impulse of growth today or next week? Is it a good idea to trade now at all? Here you go the answers.

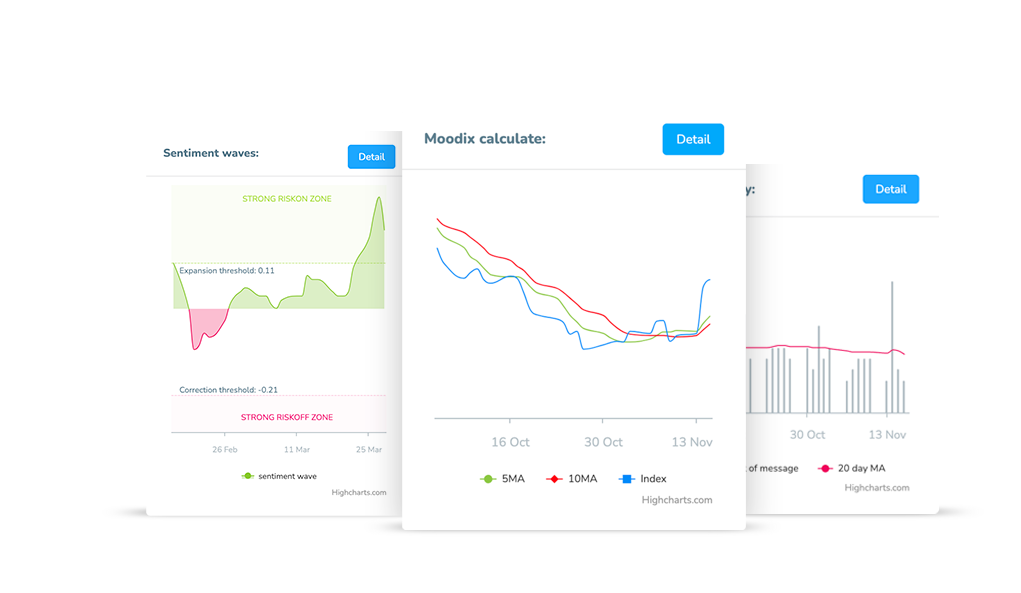

Save your time and energy. Fundamentally.

We gained the insight. Infuse it and use it within your own vision.

A fair fundamental analysis and navigating through tons of headlines might be both challenging and time consuming. As it is our passion you can invest your energy and time elsewhere.

Latest news from moodix

Tariffs Calm Fears, but Inflation Looms – What’s Next for Markets? (February 17 to February 21) – state: RiskOn

Market sentiment: RiskOn Recap of the past week: Over the past week, markets remained under pressure from Donald Trump’s trade-related headlines—ranging from global tariffs on steel and aluminum to reciprocal duties. However, based on Moodix sentiment data, market...

Growing Sentiment: BIGTECH results, calmer FOMC, and decisive PCE! (January 27 to January 31) – state: RiskOn

Market sentiment: RiskOn Recap of the past week: The inaugural week of Donald Trump’s presidency is behind us, and it’s safe to say the markets were primarily driven by his statements, declarations, and announcements. Assurances that negotiations would precede...

Strong RiskOn Sentiment, Key Fed Decisions and PCE Index Risks Ahead (December 16 to December 20) – state: RiskOn

Market sentiment: RiskOn Recap of the past week: The past week provided a mixed picture of inflation developments in the U.S. The market first received the Consumer Price Index (CPI), which rose by 0.3% month-on-month, slightly above the anticipated 0.2%. However,...

- Watch live sentiment measurement on X