Moodix market sentiment API

Access real-time market sentiment parameters with our Market Sentiment API. Integrate the moodix API into your applications and systems to stay abreast of the latest market trends and developments.

$100/month

You pay $1200 / a year or get 20% off to pay $1000 yearly

Introduction API

Leverage our Market Sentiment API for real-time insights into financial market sentiment, powered by the proprietary Moodix Sentiment Index™. This index efficiently processes the market’s response to daily news, converting it into actionable sentiment waves. The following sections provide a comprehensive guide on the API’s fields and interpreting the Moodix Index™ for strategic trading decisions.

Understanding the Moodix Sentiment Index™

Basics of the Moodix Index™ via Market Sentiment API

Our Market Sentiment API calculates the Moodix Index™ from ES futures, a highly liquid benchmark for major European and American markets. Each day, 4000-5000 news items impact these markets, but only 20-30 are critical in forming prices. The Moodix Index™ isolates these significant news items to provide a daily reset of market sentiment indicators.

Understanding Sentiment Waves through the Market Sentiment API

Track how the daily Moodix sentiment value, as captured by our Market Sentiment API, fluctuates based on the influence and frequency of significant news items. This metric clearly shows whether influential news is positively or negatively impacting market prices.

Long-Term Sentiment Measurement with the Market Sentiment API

Utilize our Market Sentiment API to gauge long-term sentiment through the ‘moodix_wave_size’ metric, which analyzes the difference between the MA10 and MA5 moving averages. This measure reflects the market’s memory and trends over the course of one and two trading weeks, presenting the sentiment as oscillating waves around a baseline.

How to use sentiment in trading

The sentiment waves guide traders on market positioning:

RiskOn (Positive sentiment): When the market sentiment is positive, traditional long strategies are advisable.

RiskOff (Negative sentiment): In negative sentiment periods, short strategies are recommended.

The Moodix Index also includes a trend field (risk) that indicates the phase of the current sentiment wave:

Growing RiskOn: An uninterrupted, positive trend.

Sideways RiskOn: A disrupted positive trend.

Fading RiskOn: Indicates the end of a positive trend.

Growing RiskOff: An uninterrupted, negative trend.

Sideways RiskOff: A disrupted negative trend.

Fading RiskOff: Indicates the end of a negative trend.

Thresholds for trading decisions

For a RiskOn wave, a moodix_wave_size reading above +0.02 suggests a strong positive sentiment.

Conversely, when the moodix_wave_size falls towards this threshold, it may signal the end of a RiskOn wave.

For a RiskOff wave, a moodix_wave_size reading below -0.3 is recommended before considering short trades, due to the market’s inherent tendency to rise.

Non-trending periods

Neutral readings indicate unclear market sentiment, suggesting a wait-and-see approach for trading.

Access Historical Market Data with Our Special API

Explore extended capabilities with our special API, which includes historical market sentiment data dating back to 2019. This feature allows users to analyze long-term trends and perform back-tests with historical sentiment indices. Ideal for researchers and traders looking for in-depth market analysis. For more details and to discuss custom solutions, please contact us directly.

API Fields

Here’s how the moodix API fields relate to the sentiment index:

created_at: Timestamp of the data point.

sentiment: The current sentiment value.

trend: The current trend in market sentiment.

sentiment_wave: The sum of daily measured values for sentiment.

volatility_index: Measures the volatility based on sentiment.

moodix_index_intraday: The intraday Moodix index value.

news_volume_intraday: The volume of intraday news items measured.

volatility_index_intraday: Intraday volatility based on sentiment.

moodix_index_week: The weekly Moodix index value.

news_volume_week: The volume of weekly news items measured.

volatility_week: Weekly volatility based on sentiment.

moodix_index_month: The monthly Moodix index value.

news_volume_month: The volume of monthly news items measured.

volatility_month: Monthly volatility based on sentiment.

moodix_index_year: The yearly Moodix index value.

news_volume_year: The volume of yearly news items measured.

volatility_year: Yearly volatility based on sentiment.

- Watch live sentiment measurement on X

Continue reading to learn how moodix works, how you can use moodix in your trading, or how to integrate moodix data into your trading systems via API.

How moodix works?

The moodix measurement is based on the thesis that most major market movements and trend changes in financial markets are the result of the impact of some of the endless stream of (more or less) chaotically emerging news. So-called "breaking news". This news, in aggregate, create positive or negative pressure and defines the sentiment of global financial markets.

How to use moodix sentiment?

Thanks to moodix measurements, we identify the mood and trend of the markets precisely. We time the market! See how you can implement the measurement into your own trading.

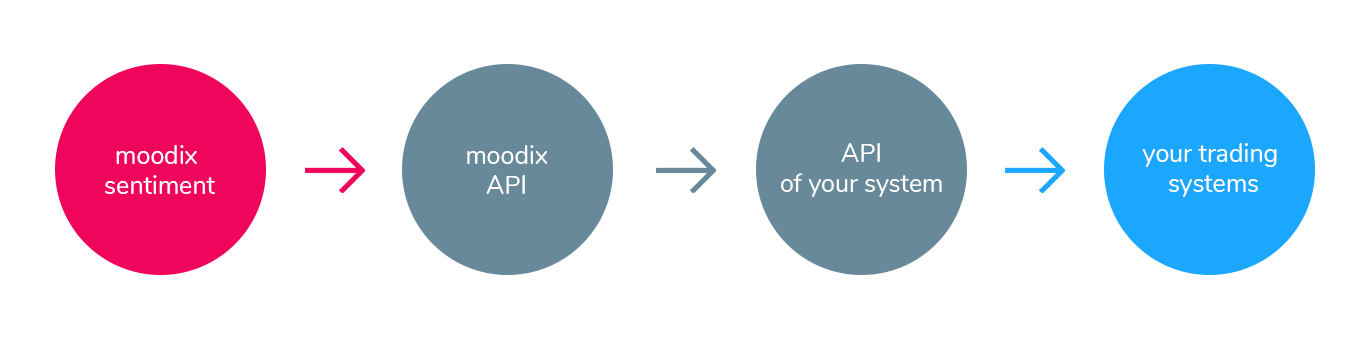

moodix API

If you run your own algo systems or have your own trading platforms, you can get up-to-date sentiment status using API connections. According to the above, you can create custom decision trees and implement moodix API into your systems.