Market sentiment: RiskOn

Recap of the past week:

The past week revolved around the U.S. labor market, which delivered results well above expectations. The most dramatic moment came with the announcement (and subsequent cancellation) of martial law in South Korea, briefly shaking up the markets. Otherwise, the mood was largely one of anticipation as investors set their sights on the coming week, which promises to bring a decisive conclusion to 2024’s market narrative.

Market sentiment indicator remained in RiskOn territory.

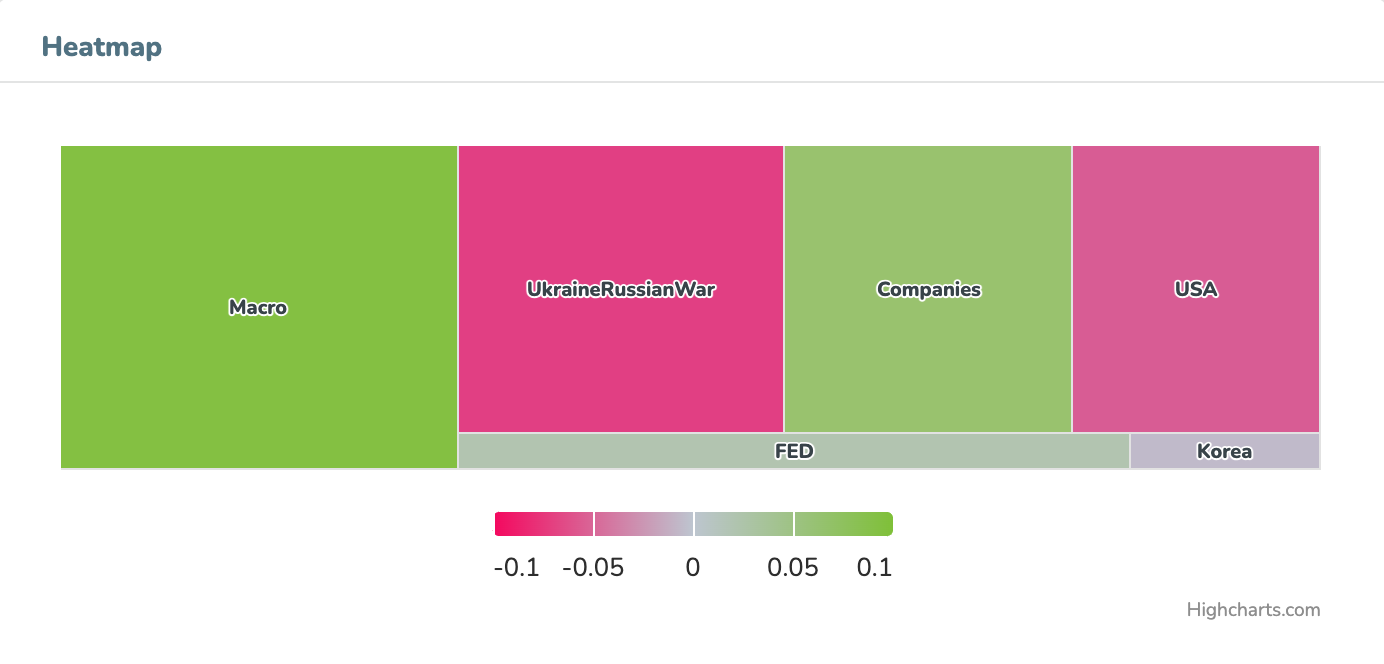

Below is the heatmap of last week’s key topics:

Outlook for the following week:

Let’s have a look at the following week from the economic calendar perspective.

Monday kicks off in Asia with Japan’s GDP and China’s CPI. No significant changes in the economic outlook are expected, but any unexpected decline could fuel increased market speculation for further monetary easing. In Europe, we’ll see the Sentix Investor Confidence Index, while in the U.S., the focus will be on October’s Wholesale Inventories data. We do not anticipate that the market will react in any way to the current developments in Syria.

Tuesday begins with China’s Trade Balance figures, followed by the Reserve Bank of Australia’s (RBA) interest rate decision, with no change anticipated. In Europe, we’ll get a fresh reading on Germany’s CPI, while in the U.S., the market will digest Q3 Non-Farm Productivity and Unit Labor Costs.

Wednesday is definitely the macro day of the week, featuring the much-anticipated U.S. CPI report. The market expects figures to remain consistent with last month, though the headline YoY CPI is forecast to tick up from 2.6% to 2.7%. Such numbers would be viewed as positive for the market, as the Federal Reserve would prefer to avoid any upside surprise in core CPI. Any larger-than-expected jump in CPI could force the Fed to adjust its stance, jeopardizing the expected December rate cut. So far, the Fed appears committed to delivering one final rate reduction before the end of the year.

Thursday could be well dubbed as “Central Bank Day,” with the Swiss National Bank (SNB) and the European Central Bank (ECB) both announcing their rate decisions. Both are expected to cut rates by 25 basis points, although speculation is mounting that the ECB could opt for a more aggressive 50 basis-point reduction. During the U.S. session, markets will focus on the usual weekly U.S. jobless claims report, along with U.S. Producer Price Index (PPI) inflation data. The significance of PPI will depend on the previous day’s CPI figures, with a higher CPI placing greater weight on the PPI release.

Friday starts with Japan’s manufacturing data and GfK Consumer Confidence (December). Later in the day, attention shifts to the UK, with the release of Trade Balance, Industrial Production, and Manufacturing Production figures.

Long-term sentiment

The ongoing positive sentiment (see more on waves statistics) remains firmly intact, having successfully absorbed all of the “disruptions” from the past few weeks. However, a key test now lies ahead with the upcoming U.S. CPI data. From our perspective, the December rate cut is a done deal, and it would likely take a significant surge in CPI to force the Fed to change its course.

Given the current market sentiment, we continue to favor long trades. If no new market-moving catalysts emerge, we expect the S&P 500 to hover around the 6100-point level as it awaits Wednesday’s CPI figures. With only one major event remaining for the year — the Fed’s interest rate decision — this level could serve as a potential launchpad for a year-end rally. Positive CPI figures may set the stage for a final push higher, as traders seek to close out the year on a strong note.

Good luck! Team moodix!