Market sentiment: RiskOn

Recap of the past week:

The past week provided a mixed picture of inflation developments in the U.S. The market first received the Consumer Price Index (CPI), which rose by 0.3% month-on-month, slightly above the anticipated 0.2%. However, the Producer Price Index (PPI) painted a far more concerning picture. It unexpectedly climbed by 0.4%, defying expectations of a slowdown to 0.2%. Aside from these inflation surprises, the markets remained relatively calm, with volatility reflecting a holiday-like pace.

Market sentiment indicator remained in RiskOn territory.

Outlook for the following week:

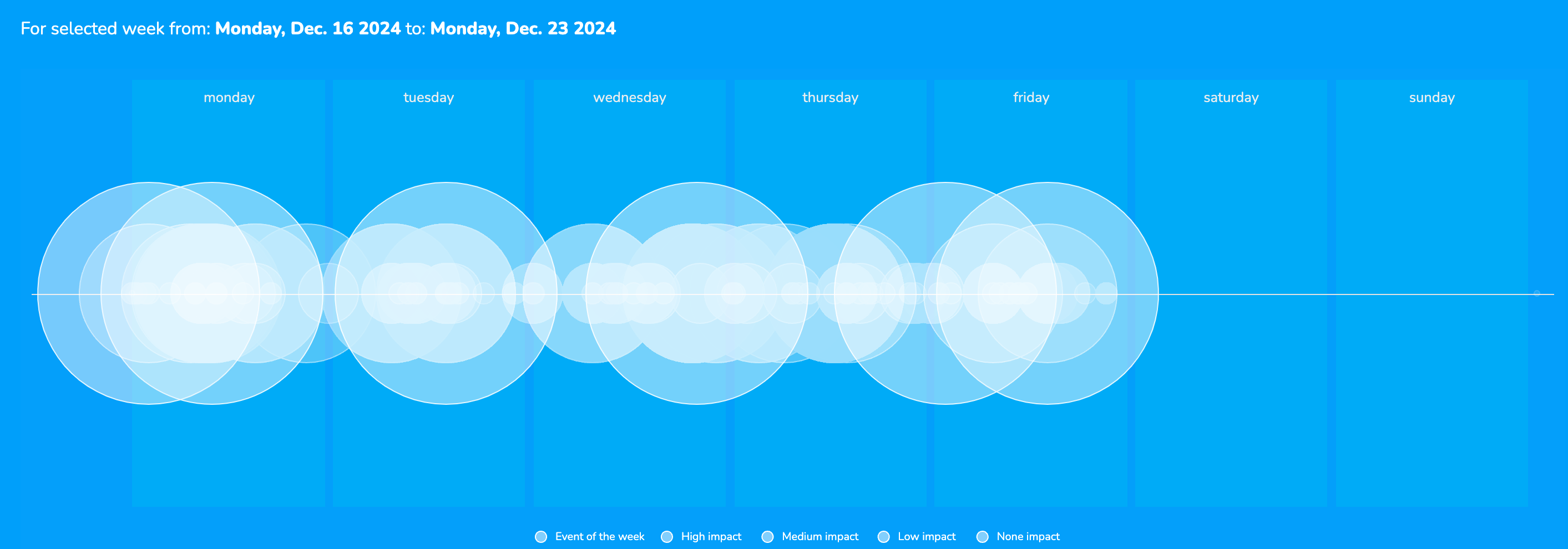

Let’s have a look at the following week from the economic calendar perspective. The upcoming week is set to be packed with key economic data and pivotal events.

On Monday, the week kicks off with crucial data from China, including Industrial Production and Retail Sales. During the European trading session, preliminary PMI figures for December from major EU economies will be released, with U.S. PMI data following later in the day. The main focus will be on whether Europe shows any signs of economic recovery after November’s underwhelming results.

Tuesday will bring UK labor market report in the spotlight, accompanied by Germany’s IFO and ZEW indices. Across the Atlantic, Canada will release its CPI figures, while the U.S. will deliver Retail Sales and Industrial Production reports. These figures will provide further insight into the health of the North American economy.

Wednesday is definitely the macro day of the week, as all eyes will be on the Federal Open Market Committee (FOMC) meeting. A 0.25% rate cut is widely anticipated, but any decision to leave rates unchanged would be a major market shock. The most critical event, however, will be the post-meeting press conference held by Fed Chair Jerome Powell, where traders will seek insight into the central bank’s current outlook and policy direction.

On Thursday, the Bank of Japan (BoJ) will announce its interest rate decision. No change is expected from the current 0.25% rate, but the subsequent press conference will be crucial in gauging the BoJ’s future monetary stance. Later in the European session, the German GfK Consumer Climate survey and the Bank of England’s (BoE) interest rate decision will be released. Similar to the BoJ, no change in the BoE’s current policy is anticipated. During the U.S. session, the usual Thursday update on U.S. jobless claims will be released, alongside quarterly PCE data, the Philadelphia Fed Manufacturing Survey, and the Kansas Fed Manufacturing Activity report for December.

The week concludes with China’s interest rate decision on Friday. No change in rates is expected, but comments from the People’s Bank of China (PBoC) will be closely analyzed for signs of future monetary policy adjustments. During the European session, the UK will release Retail Sales and Industrial Production figures, while later in the U.S. session, key inflation data will be revealed via the Core PCE index and the December update of the Michigan Consumer Sentiment Index. These figures will add vital context to the broader inflation outlook in the U.S. economy.

A view of the economic calendar according to circular heatmaps:

Long-term sentiment

The positive RiskOn sentiment, which has hovered near all-time highs (ATH) for an extended period, remains intact (see more on waves statistics). However, a figurative “blanket” of caution, stemming from the latest inflation readings, is currently capping further market growth. This restraint could be short-lived if this week’s key events produce favorable outcomes. The FOMC meeting and Friday’s PCE release are of particular importance. There is little reason to believe that Fed Chair Jerome Powell would want to disrupt the festive market mood, especially as the holiday season approaches. For this reason, the strategy remains focused on seeking long trades and buying into any market dips that may arise.

Good luck! Team moodix!