Market sentiment: RiskOn

Recap of the past week:

The inaugural week of Donald Trump’s presidency is behind us, and it’s safe to say the markets were primarily driven by his statements, declarations, and announcements. Assurances that negotiations would precede any potential tariffs brought significant relief to the markets. Additional optimism stemmed from remarks about a possible trip to China and Trump’s willingness to negotiate with his Russian counterpart. Later, however, more market-negative statements followed, some of which hinted again at the premature introduction of tariffs. While some of these remarks caused strong immediate reactions, the well tempered market totally absorbed such proclamations.

Market sentiment indicator remained in RiskOn territory.

Outlook for the following week:

From the economic calendar perspective, the week ahead promises to be exceptionally busy.

On Monday we’ll kick things off with a light start in terms of macroeconomic data. The main highlights include China’s PMI figures, Germany’s IFO Business Climate Index, and new home sales data in the US. After the market closes, we’ll see earnings from AT&T.

On Tuesday, the macro calendar lacks big events, featuring only US Durable Goods Orders and Consumer Confidence. However, the spotlight will shift to a slew of corporate earnings, including SAP, The Boeing Company, Lockheed Martin Corporation, Starbucks Corporation, and General Motors Company. These reports will provide valuable insight into the performance of major global companies.

On Wednesday, the macro day of the week, all eyes will be on the Federal Reserve as it announces its interest rate decision. No rate cuts are expected this time. The Fed’s last meeting caused significant market anxiety, but since then, they’ve received supportive data, including December’s solid PCE figures and a CPI report that came in below expectations. Jerome Powell is likely to sound more optimistic about recent developments. This meeting will also mark the first FOMC decision under Donald Trump’s presidency. It will be fascinating to see whether Powell addresses Trump’s calls for rate cuts. Questions on this topic will likely surface during the press conference, making it an important event to watch, especially in the context of the Fed Chair-President dynamic. Earnings season heats up after the market close, with results from Microsoft Corporation, Meta Platforms, Inc., Tesla, Inc., and ASML Holding N.V.. This will be the first wave of reports from the heavyweight Big Tech companies.

On Thursday, another action-packed day awaits. The European Central Bank is expected to announce a 25-basis-point rate cut. We’ll also receive the first estimate of Q4 US GDP, with forecasts pointing to a slowdown from 3.1% to 2.7%. Additionally, the quarterly PCE index will be released. After the market closes, earnings reports from major players such as Apple Inc., Visa Inc., Mastercard Incorporated, Shell plc, and Caterpillar Inc. will be in focus. Apple’s report, in particular, will be closely watched to see whether rumors of declining sales are confirmed. If so, the stock could face significant pressure.

Friday will round out the week with Japan’s CPI, Germany’s Retail Sales and CPI, but the market’s primary focus will be on the US PCE index. Investors will be looking for further evidence of easing inflationary pressures. This data will likely be referenced by Jerome Powell during Wednesday’s press conference. The earnings calendar also remains packed, with notable reports from Amazon, Inc., Exxon Mobil Corporation, AbbVie Inc., and Novartis AG.

Starting Wednesday, China will begin celebrating the Lunar New Year. As a result, we can expect reduced volatility during Asian trading sessions.

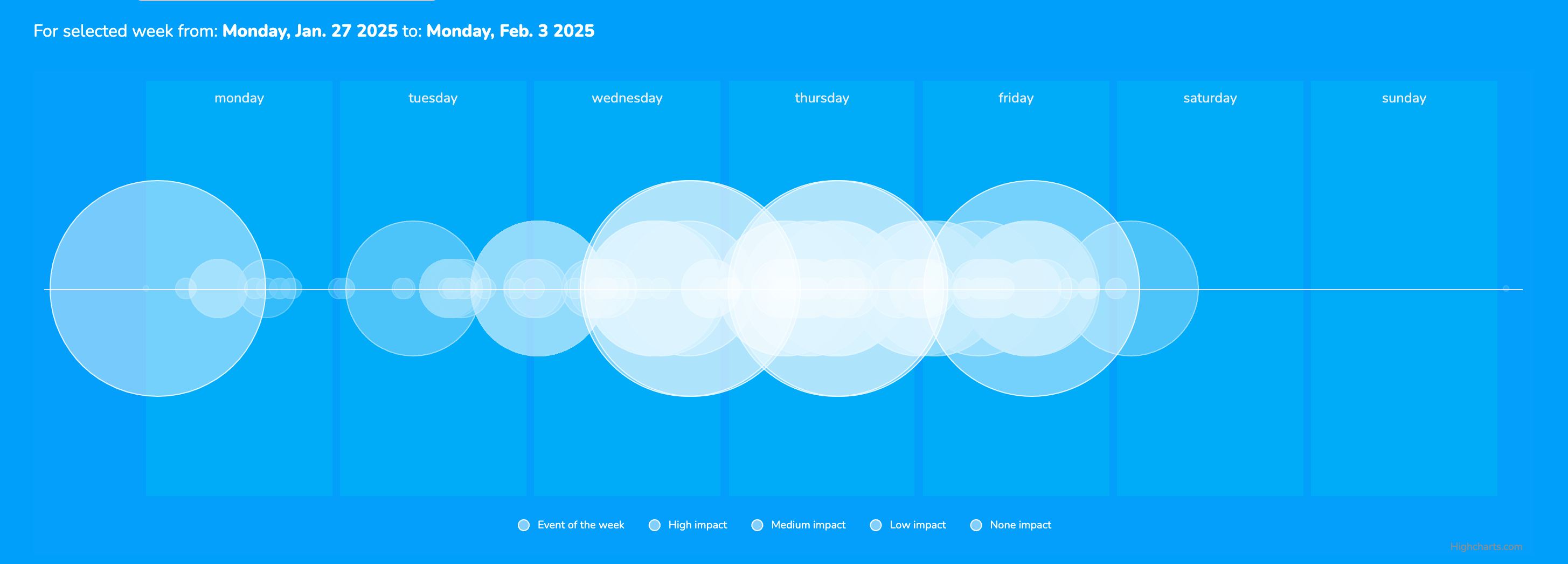

A view of the economic calendar according to circular heatmaps:

Long-term sentiment

Donald Trump has truly captivated financial markets. The current Risk-On sentiment, as measured by Moodix, has reached its highest level since tracking began (see more on waves statistics). Wow.That said, this week will test the ongoing euphoria with the release of key hard data. We’ll be monitoring Big Tech earnings, the FOMC decision, and Friday’s critical PCE report.

We expect Big Tech to deliver another set of stellar results, while the FOMC meeting is likely to be more subdued compared to December. However, the outcome of Friday’s PCE will ultimately determine whether this sentiment holds steady. Lastly, let’s not forget Trump’s “unexpected” comments—they could dramatically alter the outlook at any moment. Our strategy for new long trades is to wait until after the FOMC meeting and Powell’s press conference.

Good luck! Team moodix!