Market sentiment: RiskOn

Recap of the past week:

Over the past week, markets remained under pressure from Donald Trump’s trade-related headlines—ranging from global tariffs on steel and aluminum to reciprocal duties. However, based on Moodix sentiment data, market reactions to “Trump news” appear to be losing intensity, suggesting that investors are gradually tuning out his rhetoric.

With that in mind, the focus shifted to fresh U.S. inflation data, including CPI and PPI, both of which came in weaker than expected. As a result, inflation will likely remain a key market driver in the coming months. Nevertheless, market sentiment indicator moved decisively into risk-on territory, embracing a more optimistic outlook despite inflationary concerns.

Outlook for the following week:

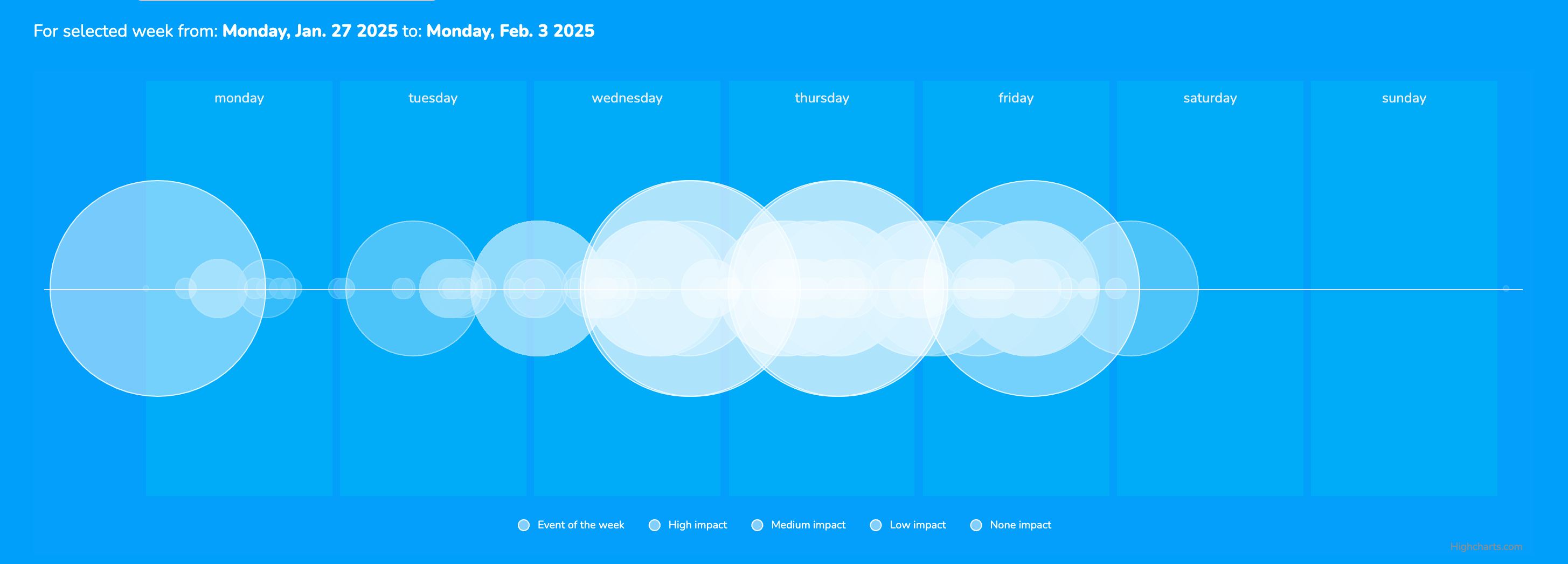

Let’s have a look at next week from the economic calendar perspective:

On Monday, U.S. markets will be closed for Presidents’ Day, which will likely result in lower volatility. However, the economic calendar still holds key events, including Japan’s Q4 2024 GDP report and speeches from Fed’s Harker and Bowman.

Tuesday’s session kicks off with Australia’s interest rate decision, followed by the UK labor market report and Germany’s ZEW Economic Sentiment Index. In the U.S. session, attention turns to Canada’s CPI, which will be watched more closely than usual, alongside the NY Empire State Manufacturing Index (Feb). Fed members Daly and Barr are also scheduled to speak.

Wednesday begins with New Zealand’s interest rate decision, followed by UK inflation data and retail sales figures. However, the main event will be the release of the FOMC meeting minutes. This will be particularly interesting, as the minutes predate the recent surge in inflation seen in the latest CPI and PPI reports. Markets will be looking for any hints about how the Fed might react to these developments. Later in the evening, Fed Governor Jefferson is set to deliver a speech.

Markets on Thursday will focus on Australia’s employment data and China’s central bank (PBoC) interest rate decision, with no changes expected (rates likely to remain at 3.1%). Europe will bring Germany’s PPI, while the U.S. session will feature weekly jobless claims and the Philadelphia Fed Manufacturing Survey (Feb). After the market close, Fed’s Kugler is scheduled to deliver remarks.

Friday promise to be the highlight of the week will be the first PMI estimates for February, covering both manufacturing and services. The data will start rolling in from Australia and continue throughout the day. These will be the first business sentiment surveys conducted after Trump’s tariff announcements, making them crucial in assessing the economic impact. Later in the U.S. session, attention will turn to the Michigan Consumer Sentiment Index, with a particular focus on inflation expectations, which surged by 1% in the previous report.

As has been the case since Donald Trump’s election, explosive headlines should be expected. However, much of the major trade rhetoric is likely already out, reducing the potential for market surprises. Instead, the risk now shifts toward retaliatory actions from affected countries.

A view of the economic calendar according to circular heatmaps:

Long-term sentiment

With reciprocal tariffs now officially announced, lingering market fears have subsided, leading to a fragile but positive shift toward risk-on sentiment (see more on waves statistics). While this may seem counterintuitive, the logic is simple: markets have returned to their pre-tariff growth narrative. A significant amount of capital had been sitting on the sidelines, waiting for clarity, and despite unresolved trade tensions, the market has chosen to look past them—for now.

However, the real concern being overlooked is inflation. The January inflation figures did not yet reflect the impact of new tariffs, which is a red flag for future price pressures. While neither the Fed nor the market appears too worried about a one inflation print, sustained monthly increases could trigger larger sell-offs. As a result, upcoming inflation reports will be scrutinized more closely than ever.

Additionally, this week’s soft economic data from major economies will serve as an important barometer for Trump’s policies. If signs of economic weakness fail to materialize, markets may continue to push higher.

Stay cautious, stay informed.

Good luck! Team moodix!