Market sentiment: update

As the month draws to a close, we once again present a public overview of market events in February. Right from the edge of the month of February, there was a certain trend-less environment in the markets. The January rally in the earnings in BIG TECH (and not just TECH, most results were) was winding down as the Gaza and Red Sea conflict and unexpectedly high NFP readings were weighing negatively on the markets. All of that was changed after the revised December US CPI from 0.3% to 0.2% was released. This injected some hope for a stronger decline in US CPI for January into the markets. This did not materialize and instead of it both the CPI and PPI data did not turn out well at all and clearly pushed back a potential Fed cut in March and triggered a fairly clear negative sentiment on top hand with hand with shift of market sentiment indicator. Then the market got absolutely great results from nVidia and pushed (with the help of the entire TECH segment) the SP500 to new all-time highs. See more here: https://app.moodix.market/month

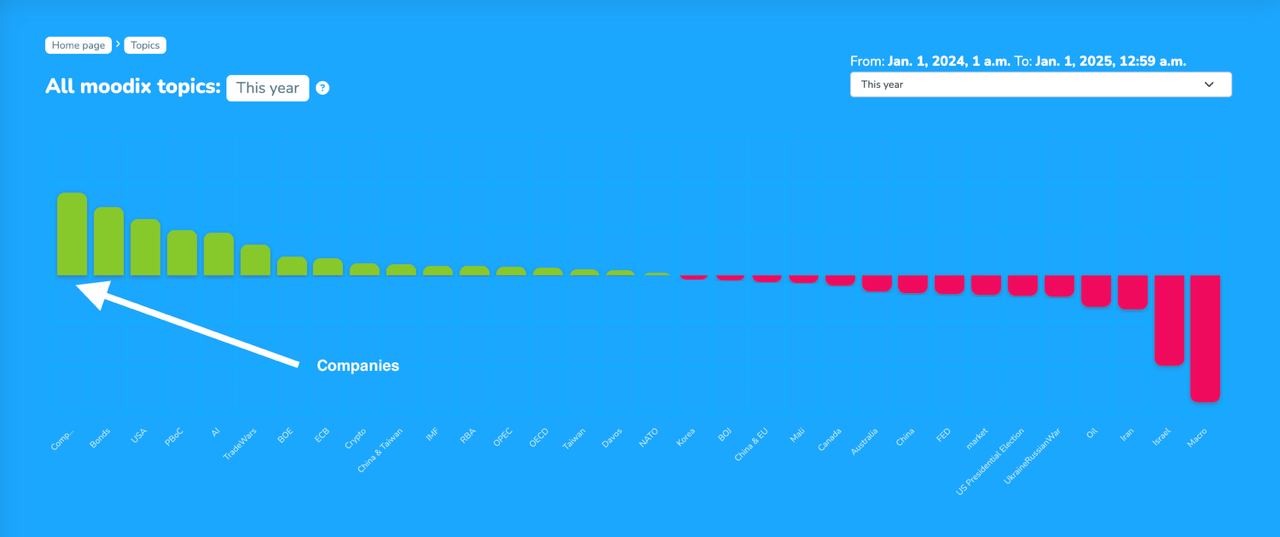

Generally spoken, main drivers (main topics) of growth for this part of the year were good corporate results, the bond market (expectations were very low given the size of the debt allocation) and developments in China with their rate cuts and declared determination to stop the declines in Chinese indices. See more here: https://app.moodix.market/topics/

Currently, the market is absorbing both the great results from nVidia and the emerging AI segment, but also certain disappointment from the Fed’s postponement of the first rate cut. The market still holds onto hope for an early end to the fighting in Gaza. We are seeing pressure for a correction in the market. The market lacks positive news and a theme to hold on to. Reactions to negative news are rather small and clearly show that there is no sentiment that has the power to trigger a deeper correction at the moment. You can see the volatility of the news here: https://app.moodix.market/volatility/

Today, on the last day of February, we are about to get new PCE index readings. In the past, the Fed clearly declared that this index is as important to them as the CPI itself. Therefore, the PCE figures definitely have the potential to break the current trend-less environment. This can best be seen in the sentiment calculations here: https://app.moodix.market/moodix-calculate

If we get data that deviates significantly from expectations, we can expect a strong move in the market. If the data drops significantly, the market will likely end its bets on a correction and return the index close to the ATH. A significant increase, on the other hand, will confirm the thesis of an incoming correction. No one could be surprised after all. The SP500 has hit a hard to believe 24% since October and is very likely at its limits. Overall, February was lackluster and currently the SP500 is holding gains of around 2.5%.

Good luck