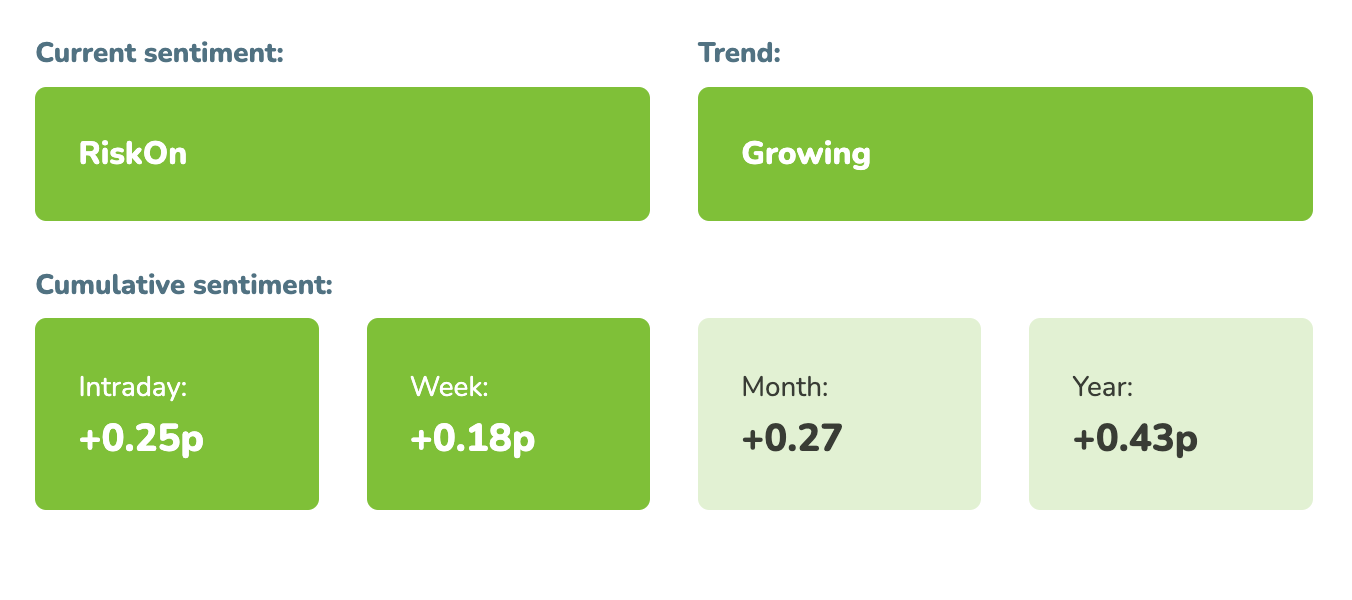

Market sentiment: RiskOn 14 days

Recap of the past week:

The first week of the month usually tends to be very sluggish. Due to the shift of the macro event NFP, the market was in a certain tension throughout it. In addition, we closely followed the 2-day hearing of Jerome Powell in the House of Representatives. It was an interesting week which despite this fact did not offer any clear arguments for the next direction. On one hand, the market received hints of a possible slowdown from non-manufacturing indicators; on the other hand, it revealed cooling but still a relatively strong labor market.

Outlook for the following week:

Next week, however, will be a completely different story. On Tuesday, the main macro day of March, we will get the fresh US CPI data for February. This Tuesday will pretty likely decide the future direction of the markets. A Year-Over-Year increase of +3.1% (unchanged) and 3.7% (down from 3.9%) for the core is expected. Anything above could trigger a broader correction and delay the first rate cut. Anything below would fuel hopes for an early first rate cut by the Fed (bringing May back into play). The rest of the week will be rather poor on macro data. But gradually:

On Monday, we start off lightly with just an update on Japanese GDP, Chinese M2, New Loans, and Foreign Direct Investment, and a US 3-year Treasury note auction.

Tuesday, the main macro day of the week, begins in Asia with Australian Consumer Confidence, Japanese PPI (February). In Europe, the main data will be German CPI (February) and the UK labor market. In the US, the focus will mainly be on the US CPI (February). Afterward, the market will be interested in the demand and yield of the US 10-year Treasury note auction.

On Wednesday, the primary focus will be on data from the EU session. We will receive Industrial and Manufacturing Production from the EU and the UK.

On Thursday, we’ll get a standard weekly overview of the US labor market, US Retail Sales, and a closely watched US PPI.

On Friday we’ll first get Chinese home sales during the Asian session and then Italian and French CPI. During the US session, we will see the NY Empire State Manufacturing Index (March) and the Michigan Consumer Sentiment Index (March).

Long-term sentiment

Moodix market sentiment indicator returned to the growth-oriented RiskOn and closed the week at its strongest levels in the last month. This was mainly due to the strong labor market fueling hopes for a soft landing. Trading systems will be turned off until the release of the US CPI readings and then, if they maintain a positive RiskOn sentiment, will begin to look for long trades.

Good luck! Team moodix!