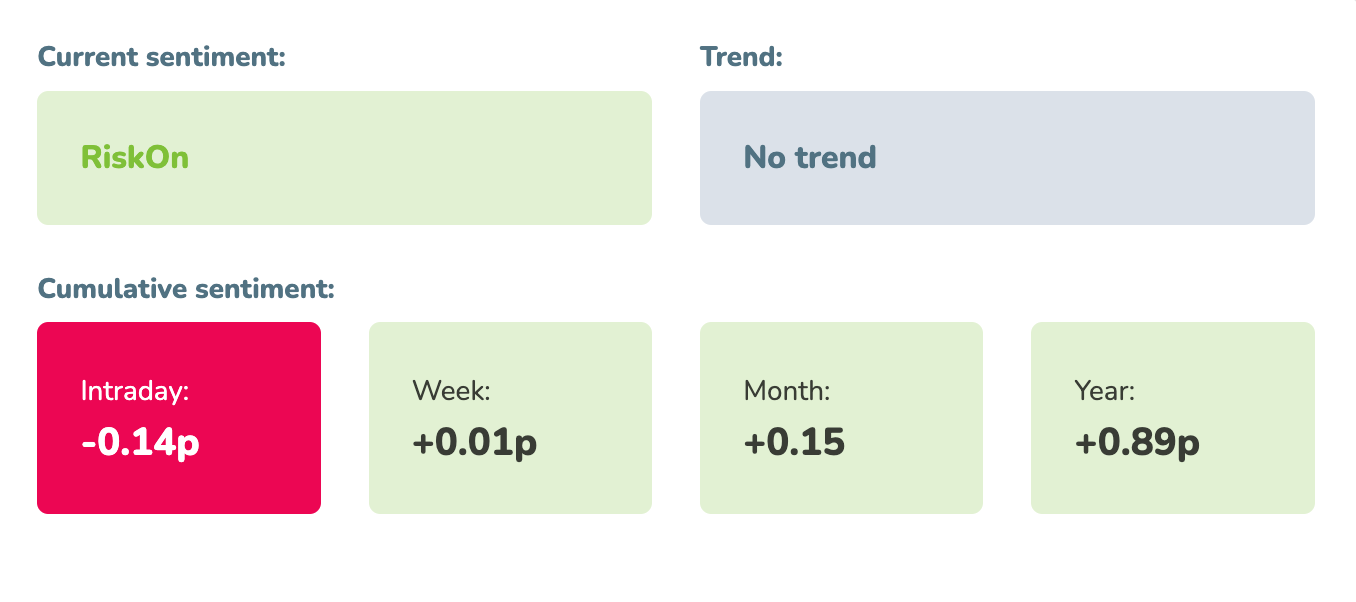

Market sentiment: RiskOn – 10 days

Recap of the past week:

The past week didn’t offer much excitement, yet despite low volatility, the S&P 500 managed a 2% gain, largely attributed to a buoyant RiskOn market sentiment. The main highlight was the weekly overview of the U.S. labor market. Conversely, concerns arose due to a decline in the Friday Michigan sentiment index and a rise in its inflation component.

Outlook for the following week:

This week could very well be pivotal. On Wednesday, we’ll receive fresh CPI data, which we can definitively say will be the main catalyst for market rises or falls for the next four weeks. Currently, the market is solely focused on solving the puzzle of “when the Fed will make its first rate cut.” After months of disappointing inflation data, the market needs to see any decrease. Otherwise, we could see a swift drop below the 5000 point level on the S&P 500. Either way it’s gonna determine the direction of current wave of mood. But let’s take it step by step:

Monday doesn’t hold anything major, except perhaps inflation expectations from New Zealand and speeches by Fed central bankers during the US session.

Tuesday will start heating up. During the EU session, we will get the April CPI update from Germany, fresh data from the UK labor market, and the ZEW index for Germany and the EU. In the US, we’ll get the first batch of inflation data, the US PPI, where no major changes are expected, and it could only surprise negatively.

On Wednesday, the main macro day of the week, we start in the EU with the first estimate of Q1 GDP. Then, we’ll wait for the macro of the week, the US CPI for April. The market expects a decline in both MoM and YoY indices. If we see the opposite, we can expect rapid declines across the market, rising yields, a strengthening USD, and a change in outlook for the first rate cut by the Fed. If inflation does decrease, the market might build on gains from the last two weeks and start speculating on a possible cut in June or July. Currently, the market is counting on the first cut in September.

Thursday will bring data from Australian labor market in Asia and then weekly labor market data update during US session, followed by home sales readings, the Philadelphia Fed Manufacturing Survey (May), Capacity Utilization (April), Industrial Production (April), ending with speeches by Fed’s Mester/Bostic.

On Friday, the focus will mainly be on figures from the Chinese economy: House Price Index, Fixed Asset Investment, Industrial Production, FDI, New Loans, and Retail Sales—all April readings. The rest of the day will bring just the update on April Eurozone CPI and Swiss Industrial Production.

Long-term sentiment

Last week, the market maintained a slight positive RiskOn sentiment – as shown by our market sentiment indicator – and Wednesday’s US CPI results will determine its fate. Trading systems are to remain off until Wednesday, waiting for the final figures. If they turn out well, we’ll return to the market more actively. Otherwise, we will just wait to see how strong the negative sentiment turns out (which is always a matter of a few days).

Good luck! Team moodix!