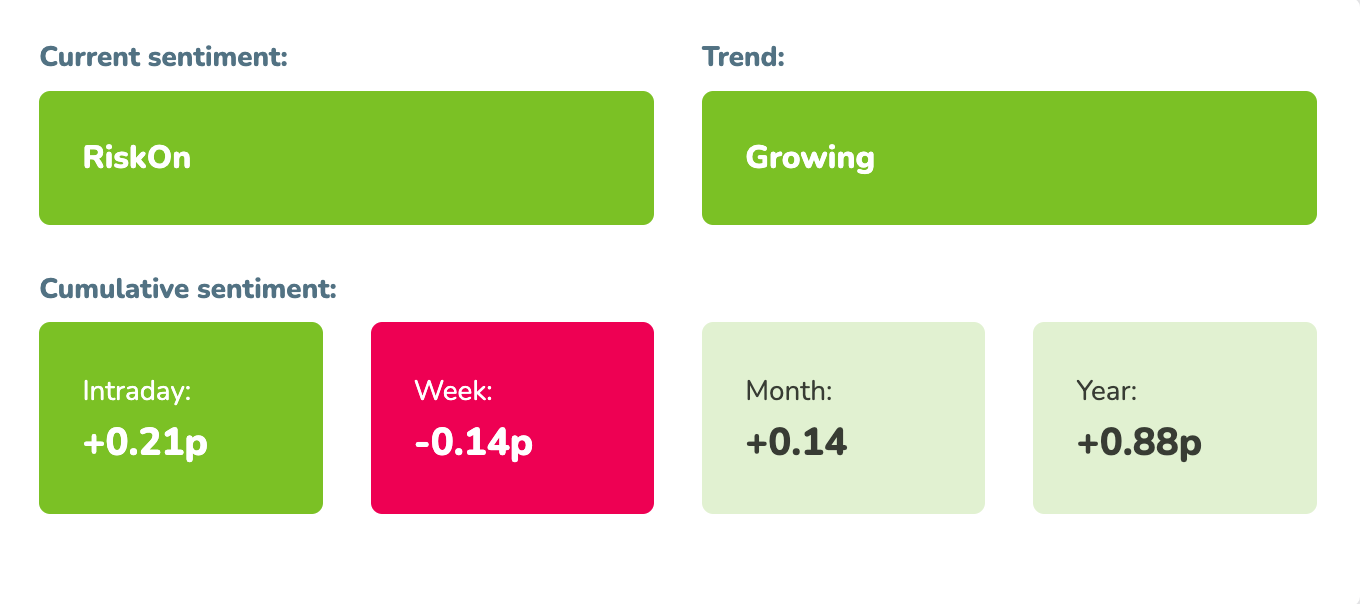

Market sentiment: RiskOn 3 days

Recap of the past week:

Last week, the markets were poised in anticipation of the FOMC meeting and the subsequent press conference by Jerome Powell. Beyond the expected slow pace of quantitative tightening, no significant new developments emerged. The Federal Reserve appeared convincing, considering the current inflationary pressures as temporary. The slightly slowing job market, particularly noted in the NFP data, played into the Fed’s narrative. However, a noticeable rise in Friday’s ISM services prices tempered the market’s enthusiasm. Nevertheless, the market ended the negative sentiment wave and market sentiment indicator switched to RiskOn.

Outlook for the following week:

After several weeks challenging both macro and earnings perspectives, we’re heading into a quieter period. In the US, the focus will largely be on speeches by central bank officials, shifting traders’ eyes more towards Europe and Asia as the earnings calendar begins to thin out. Most significant earnings announcements for the current season, such as Disney, BP, Airbnb, and UBS, are behind us and will no longer have a major impact on the market which will rather wait for next week when we get fresh US CPI.

Week Ahead:

Come Monday, attention in Asia turns to Australian inflation and Chinese PMI services, while Europe also reports service PMI, PPI updates, Sentix Investor Confidence for May, and a speech by the chairman of the Swiss National Bank. The US will see a speech from Williams of the Fed and US Loan Officer Survey data for Q1.

Tuesday starts with UK retail sales and Australian rates, followed by German factory orders, EU retail sales, and Canadian PMI. Only a speech from Kashkari of the Fed is scheduled in the US.

Midweek highlights include Germany’s industrial production for March.

Thursday brings the Chinese trade balance and keenly watched Bank of England rates, with significant interest in any voting shifts given the UK’s inflation trajectory.

On Friday, the main macro day of the week as shown in our macro calendar, Asia sees PMI data from New Zealand and Japan’s Current Account balance. Europe focuses on robust UK data expectations: GDP (forecasted strong growth), Industrial Production, and Manufacturing Production. The US concludes with Canadian labor market data and the highly anticipated Michigan Consumer Sentiment Index for May, including closely monitored inflation expectations.

Long-term sentiment

Post-FOMC, the market shifted from a negative RiskOff market sentiment wave to a mildly positive sentiment. It is expected that the market will not engage in significant movements as it awaits next week’s fresh US CPI data, with more clarity needed on the inflation front for upward momentum. Trading strategies will likely seek cautious long positions.

Good luck! Team moodix!