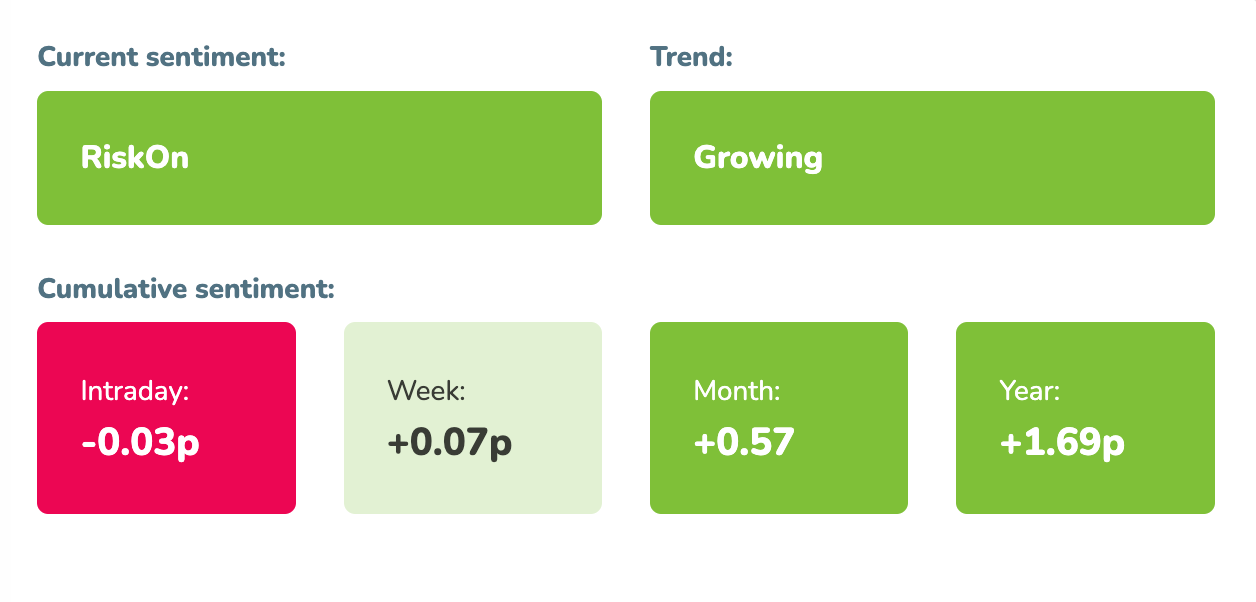

Market sentiment: RiskOn – 24 days

Recap of the past week:

The past week was primarily about waiting for Friday’s data releases. We received the PCE index (slight decline as expected), the Michigan Sentiment Index, and the Chicago PMI. The SP500 index ended almost unchanged, surrendering most of its gains on Friday following excellent data. This was largely due to issues in Yemen and the anticipation of the French elections. Market sentiment indicator remained in RiskOn territory.

Outlook for the following week:

From an economic calendar perspective, we’re starting off unexpectedly brisk right on Monday. We have manufacturing data from Japan and China, updates on European PMIs, German inflation (initial estimates for June), and the US Manufacturing ISM. Markets will likely find some support from the results of the French elections, with the French market probably experiencing a stronger rise.

Tuesday will focus on the minutes from the latest RBA meeting, initial estimates of European inflation for June, and speeches from ECB central bankers led by Lagarde. The day will end with a speech by FED Chairman Jerome Powell and the first data from the US labor market, JOLTS.

Wednesday will bring updates on service sector PMIs, starting in China, then Europe, and ending with the US ISM. Throughout the day, we’ll also get another piece of the US labor market puzzle with the ADP index. The day will conclude with the latest FOMC meeting minutes, where the market will be searching for clues on future developments. Currently, the market is considering the possibility of the first rate cut in September.On

Thursday, the calendar is relatively empty. The main event will be the early elections in the UK. Additionally, we’ll receive German Factory Orders (May) and fresh CPI from Switzerland.

Friday is the main macro day of the week will bring a crucial piece to the US labor market mosaic: the NFP report. The market expects a decline from +272k last month to +180k. Based on current trends, job creation is expected to continue.

Long-term sentiment

Throughout the past week, the market was searching for anything to maintain the RiskOn growth sentiment (see more on waves statistics). A rather rare situation occurred where the sentiment hovered around zero for two days. Ultimately, the sentiment held and rebounded to new growth, likely supported by the outcome of the first round of the French elections. Trading systems will be looking for long trades.

Good luck! Team moodix!