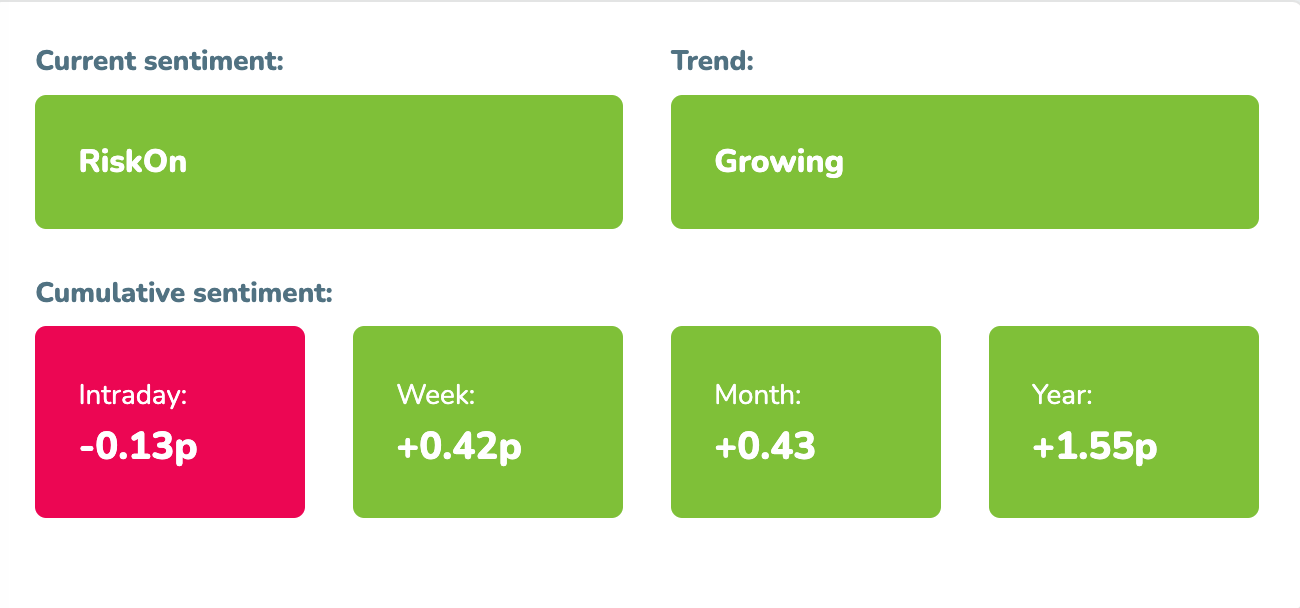

Market sentiment: RiskOn – 10 days

Recap of the past week:

The markets had been anticipating the update on the US CPI all the past week. In the end, it turned out very well, and we received very encouraging numbers. A considerable amount of euphoria hit the market. However, Jerome Powell dampened this at the FOMC meeting. He clearly indicated that further declines would be required for greater confidence in any potential rate cuts. Nevertheless, the market held up and closed the week up by +1.6%.

Outlook for the following week:

From an economic calendar perspective, next week will be quite empty, especially regarding US macro data.

On Monday, the focus will be on Chinese macro data: Industrial Production (expected to decrease from 6.7% to 6%) and Retail Sales (expected to increase from 2.3% to 3%). If these figures follow a significant decline in the Chinese PMI, it could create pressure on Thursday’s PBoC meeting.

Tuesday will get us the Australian interest rates (unchanged expected) and the fresh ZEW index for Germany and the entire EU. During the US session, we’ll see May US retail sales and Industrial Production figures.

Wednesday will mainly be about UK data – May CPIs and PPIs.

On Thursday, which could be dubbed the day of central banks, we’ll have a series of interest rate decisions. Kick off in China with the PBoC, then Switzerland with the SNB, and finally UK’s BoE. In the US, we’ll receive the weekly job market overview.

Friday is the main macro day of the week, we can expect the highly watched first estimates of PMI’s from the largest economies. We’ll get numbers from Australia, France, Germany, Italy, the UK, and then the US. A slight increase is generally expected.

Long-term sentiment

After the excellent US CPI numbers, market sentiment switched back to strong Risk-On (see more on waves statistics). If this market mood persists, the market will continue to push higher, and we can expect new all-time highs. The Moodix trading systems will be looking for long trades.

Good luck! Team moodix!