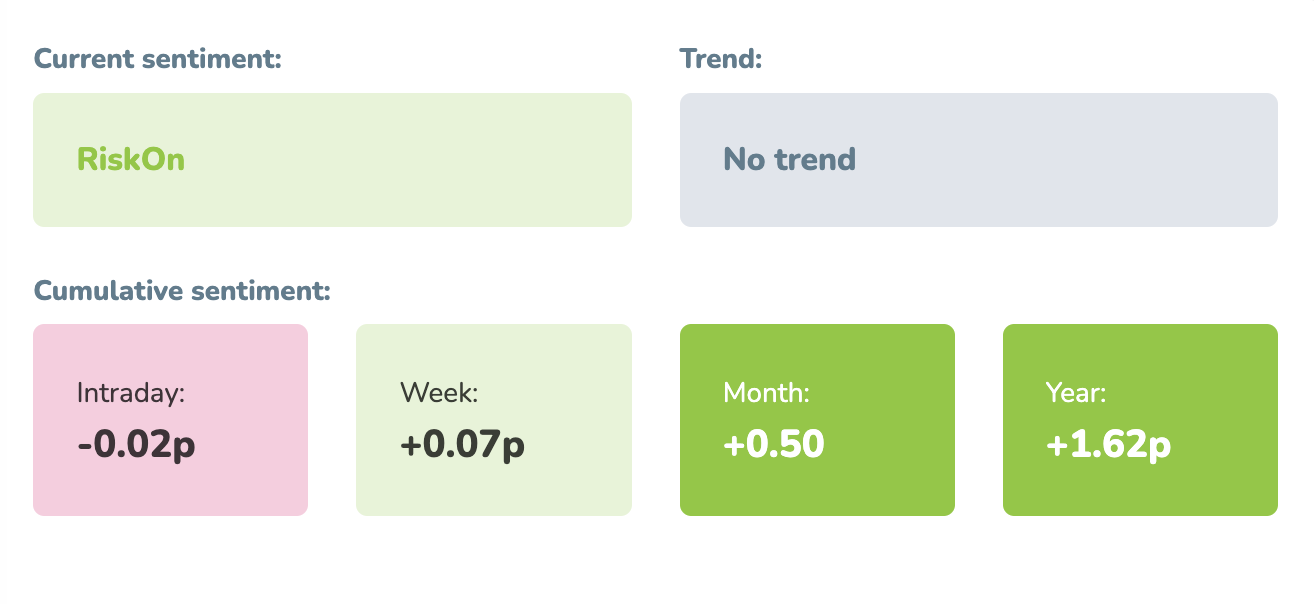

Market sentiment: RiskOn – 17 days

Recap of the past week:

The past week did not bring any major updates with almost empty macro calendar. Central banks provided their updates on interest rates. The only surprise was perhaps Bank of England’s hawkish stance. With upcoming elections in France and England, the pressure emerges. The past week though maintained market sentiment indicator in RiskOn territory.

Outlook for the following week:

From an economic calendar perspective, we’ll start slow on Monday. The only significant data includes the European IFO, the US Dallas Fed Manufacturing Business Index (Jun), and the Chicago Fed National Activity Index (May). Towards the end of the session, Daly from the FED will speak.

On Tuesday, we begin in Europe with Spain’s GDP. Main events to be seen during the US session: Canadian CPIs, US Housing Price Index (Apr), Consumer Confidence (Jun), and the 2-Year Note Auction. Throughout the day, we’ll hear remarks from Fed’s Cook and Bowman.

Wednesday will mainly focus on Australian CPI, the German GfK Consumer Confidence Survey (Jul), New Home Sales monthly Change (May), the 5-Year Note Auction, and the highly anticipated US Bank Stress Test Info. The stress test could reveal some weaknesses in the banking system of mid-sized and small banks.

On Thursday, we’ll start with Retail Sales in Japan. In Europe then Business Climate (Jun), Consumer Confidence (Jun), and the Economic Sentiment Indicator (Jun). All June data with the potential to reveal the current state of the EU economy. In the US, we’ll receive weekly labor market overview, Q1 GDP update, and the closely watched quarterly Personal Consumption Expenditures Prices. The market will likely wait for Friday’s monthly data, but even the QoQ data will provide significant insights (as seen last month).

Friday, the main macro day of the week, begins with CPI from Japan. In EU, we will be interested in German Retail Sales, the UK Q1 GDP update, and first estimates of European inflation (France, Spain, Italy). In the US, we’ll get the main data of the week, the monthly PCE. A decline is expected in all figures, which will likely push the markets upwards. Additionally, we will see the Chicago PMI (Jun), Michigan Consumer Sentiment Index (Jun), and the UoM 5-year Consumer Inflation Expectation (Jun).

Long-term sentiment

The market continues to exhibit a relatively strong Risk-On sentiment (see more on waves statistics). Unless new headaches arise, we can expect the market (especially TECH) to push further upwards with the prospect of falling inflation (and the first rate cut from the FED). Headwinds will certainly come from tensions with China, Lebanon, France, and the UK. Moodix systems will be searching for long trades.

Good luck! Team moodix!