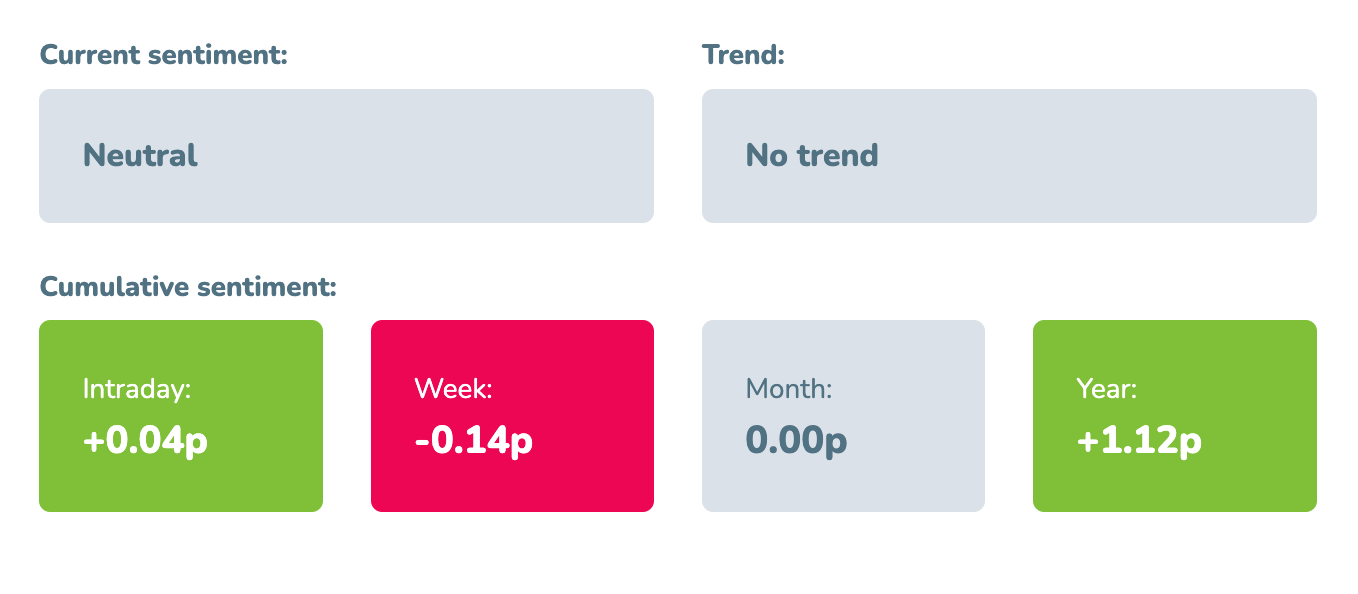

Market sentiment: Neutral 2 days

Recap of the past week:

Last week, market participants were eagerly awaiting the release of the PCE index on Friday, that has a potential to shift market sentiment indicator. Thursday’s quarterly PCE data suggested that a significant drop was unlikely, and Friday confirmed this with a slight decrease (-0.1%) in the MoM CORE PCE. Initially, the market reacted positively, but the optimism was short-lived when the Chicago PMI fell below the 2022 low, causing concern. However, the end-of-month effect kicked in, triggering a strong rally that erased most of the week’s losses, building on the mildly positive PCE data.

Outlook for the following week:

We can dub the upcoming week as the “ECB and US Labor Market Week”, at least from a perspective of economic calendar. Should the ECB cut rates as expected, it would signify a “soft landing in the EU.” Additionally, we anticipate the monthly US labor market report. A negative development in this report might be viewed positively by the market from a FED perspective. Let’s break down the week:

Monday will start sharply with China’s PMI during the Asian session. Any drop below the previous month’s value will be closely watched by the market. Subsequently, we get updates on European PMI and the highly monitored US Manufacturing PMI.

On Tuesday key points will be Swiss inflation, US Factory Orders, and the first US labor market data point: JOLTS.

On Wednesday, we’ll be focused on PMI updates in the services sector of major economies, including the US ISM Services. We also receive the second main figure from the US labor market: ADP Employment Change.

Thursday is the main macro day of the week with the ECB meeting. If expectations hold, it will be an unprecedented step with the ECB cutting rates before the FED. This would have been unthinkable just a year ago and could mark the beginning of talks about a soft landing in Europe. Additionally, we get another US labor market figure: Challenger Job Cuts.

Friday will kick off in Asia with China’s Trade Balance. In Europe, we’ll receive Industrial Production data for April, an EU GDP update, Canadian labor market data, and the final US labor market figure: Nonfarm Payrolls (NFP). The market expects an addition of 180k jobs, and such a number would indicate that the US labor market is not cooling.

Long-term sentiment

The past week saw predominantly negative news, placing the positive RiskOn sentiment under pressure, for a detail please see waves of mood. The slightly positive, trendless period since early May is likely ending. From our perspective, the market will spend the entire week preparing for June 12, when fresh CPI figures and the FOMC meeting will occur. Until then, we can expect sideways trading. Trading systems will be turned off this week.

Good luck! Team moodix!