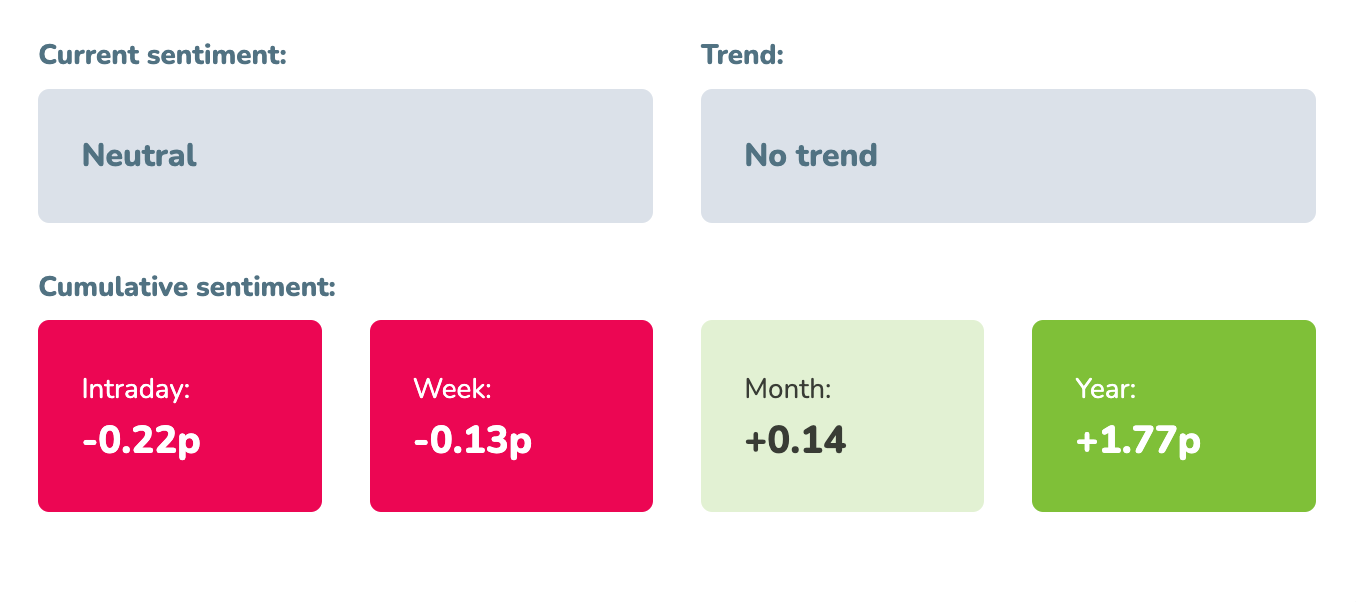

Market sentiment: RiskOff – 1 day

Recap of the past week:

The past week saw the SP500 register slight losses and the market sentiment indicator moved to Neutral zone. Right from the start, the week carried a notably negative tone. It began with disappointing macro data from China, compounded by a lack of strong signals from the Chinese parliament session. Then not that shiny earnings reports from major companies, particularly regarding their outlooks, added to the gloom, culminating in Friday’s blackout caused by CrowdStrike. As of this writing, it has been revealed that President Biden has announced his withdrawal from the US presidential race. Since this was anticipated, we don’t expect significant market reactions.

Outlook for the following week:

Let’s have a look at the following week from the economic calendar perspective.

On Monday, the only significant event will be the PBoC rate decision, where no major changes are expected. Throughout the day, we’ll get earnings from SAP SE and Verizon Communications Inc. The market will likely be digesting the weekend’s news of Biden’s withdrawal and the aftermath of Friday’s blackout.

Tuesday’s calendar is also sparse, with US home sales being the only notable event. However, after the close, we will see the first big earnings reports from Big Tech, specifically Alphabet Inc. and other like Tesla, Inc., Visa Inc., The Coca-Cola Company, and Texas Instruments Incorporated.

Wednesday will heat up from a macro perspective, with critical initial PMIs estimates from around the world. In the US, we’ll see the significant 5-year Treasury auction. Major earnings reports include Thermo Fisher Scientific Inc., IBM, ServiceNow, Inc., NextEra Energy, Inc., and AT&T Inc.

Thursday’s focus will be on Germany’s IFO Business Climate Index, quarterly PCE, and crucially, the first estimates of US Q2 GDP, which could act as a significant catalyst. We will also see earnings from AbbVie Inc. and AstraZeneca PLC.

Friday will be all about Japan’s inflation data and the monthly US PCE. We believe the market is no longer overly concerned with inflation as a standalone issue and would need a series of bad inflation readings to refocus on it. The week will conclude with the Michigan Sentiment Index and its inflation expectations.

Long-term sentiment

Thursday marked the end of a very long RiskOn wave (see more on waves statistics). According to our measurements, this was due to the ongoing earnings season and worsening macroeconomic conditions, especially in the US. The attempted assassination of Trump also injected a degree of nervousness. All of this sets the stage for this week. If companies like Google and Tesla don’t deliver strong numbers, and if the US Q2 GDP estimates fall short of expectations, the market will likely remain under pressure. Moodix trading systems are deactivated during RiskOff periods and will not trade until the next RiskOn wave.

Good luck! Team moodix!