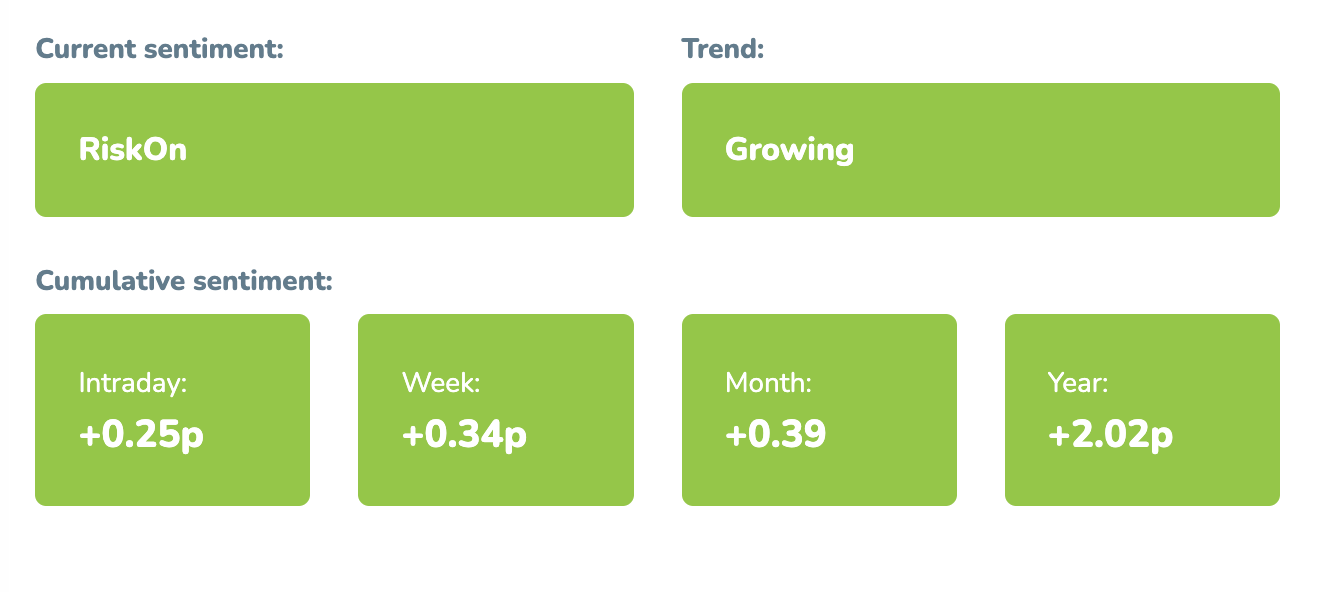

Market sentiment: RiskOn – 31 days

Recap of the past week:

Last week, influenced by US holidays and the start of the vacation season, market sentiment indicator continued on the wave of positive RiskOn sentiment, with the S&P 500 adding +1.5%. The market was largely driven by anticipation of new data from the US labor market. These data partially confirmed a further weakening of the labor market, with the unemployment rate rising to 4.1% (previously 4.0%). Nevertheless, the Non-Farm Payrolls (NFP) added an impressive +206k new jobs. However, it is expected that next month will bring downward revisions.

Outlook for the following week:

If you take look at the economic calendar and other fundamentals, the upcoming week will be seemingly influenced by several factors. The first factor is the aftermath of the surprising Sunday elections in France, where the far-left unexpectedly won. This led to a stalemate, shifting concerns from a far-right victory to a far-left one, with expectations of prolonged post-election negotiations.

Tuesday will bring the beginning of highly watched testimony of Jerome Powell in Congress. Fed Chairman Powell will testify before the Senate Banking Committee on Tuesday and the House Financial Services Committee on Wednesday. It is expected that he will reiterate his recent statements that the disinflation trend is showing signs of recovery and that they are returning to a disinflationary path.

On Wednesday, we’ll see new figures from China, including both CPI and PPI. CPI Y/Y is expected to accelerate to 0.4% from 0.3%, and M/M is expected to be 0% (previous -0.1%). PPI Y/Y is expected to show a milder decline at -0.8% (previous -1.4%). Despite these expected improvements, weak domestic demand still requires stronger stimulus measures from Beijing. The Chinese Caixin PMI indicates easing output price inflation, attributed to slower service price growth, while industrial selling prices rose for the first time this year.

Thursday is the main macro day of the week. We’ll see new CPI numbers from the US. The consensus expects the US CPI to rise by 0.1% M/M in June (forecast range 0.0–0.1%; previous 0.0%), while core CPI inflation is expected to increase by 0.2% M/M (range: 0.2–0.3%), matching May’s figure. Any stronger growth would be perceived very negatively by the markets.

Friday will kick off the earnings season with banks. We’ll get numbers from JPMorgan Chase & Co., Wells Fargo & Company, and Citigroup Inc.

Long-term sentiment

The current RiskOn wave (see more on waves statistics). has been ongoing for a month and is so far the second longest wave of positive sentiment in 2024. There is currently no indication that this trend will change in the coming week. Trading systems will continue to seek out long trades.

Good luck! Team moodix!