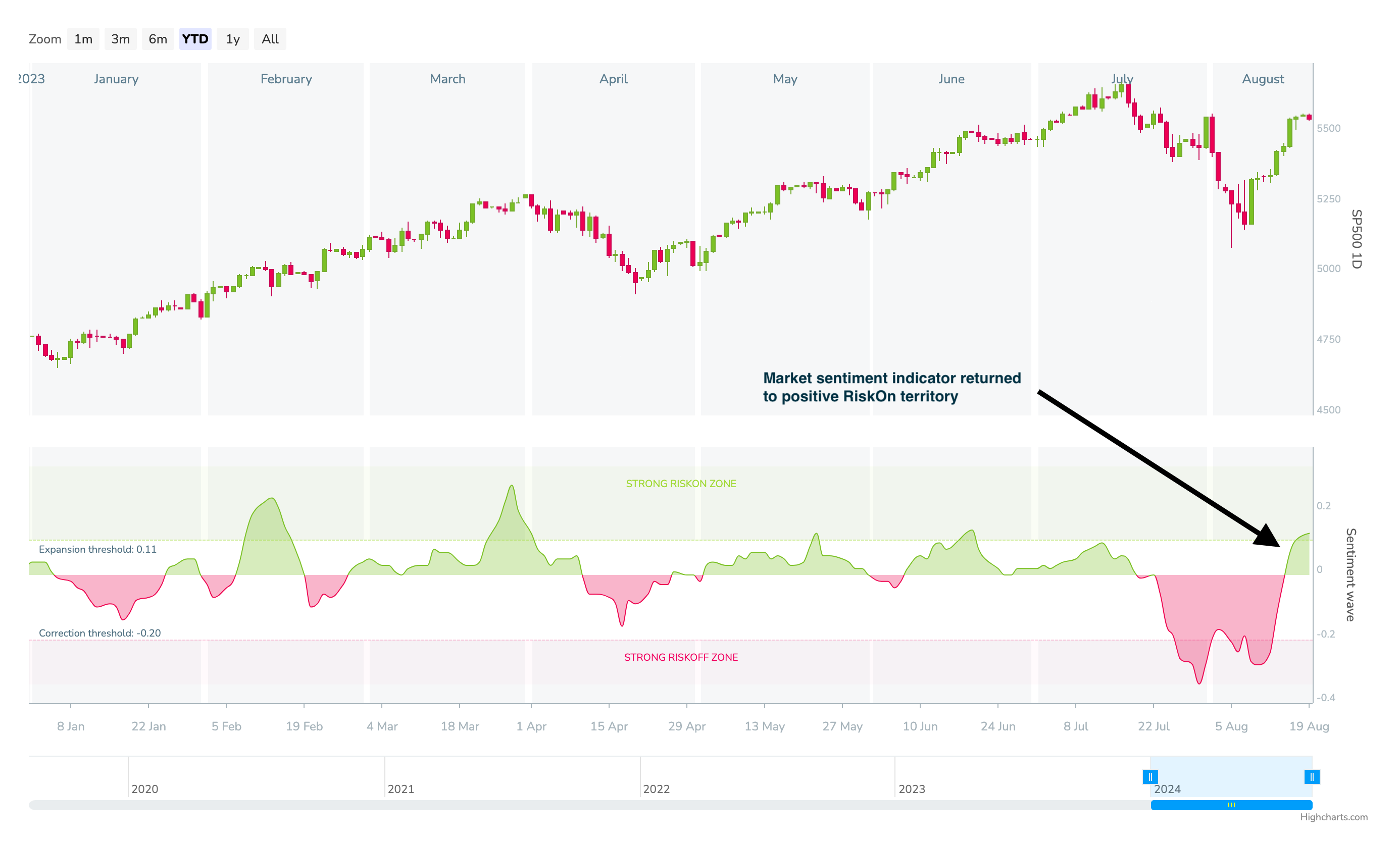

Market sentiment: RiskOn – 5 days

Recap of the past week:

The past week was all about anticipation, with markets awaiting fresh CPI data and weekly US labor market readings. The CPI results were spot on, showing only a slight decline—avoiding recession fears while not delaying the Fed’s first potential rate cut. The labor market proved robust, suggesting the last NFP was likely just a bump. As a result, the strong RiskOff sentiment eased, and market sentiment indicator returned to positive RiskOn territory:

Outlook for the following week:

Let’s have a look at the following week from the economic calendar perspective.

Monday kicks off slowly, with only a speech from Fed’s Waller on the agenda. Overall, this will be a light week for macro events in general.

Tuesday sees China’s PBoC rates and RBA minutes in Asia, German PPI, and CPI for Eurozone, followed by Canadian CPI and speeches from Fed’s Bostic and Barr during the US session.

Wednesday offers Japan’s Trade Balance, a US 20Y bond auction, and FOMC meeting minutes.

Thursday, the main macro day, brings fresh PMI data from major economies, with markets watching closely for any signs of a looming recession, particularly in US manufacturing. Last time, manufacturing dipped below the 50-point mark, indicating contraction. Also, the Jackson Hole Symposium, big event for monetary policy heavyweights, hosted by the Fed, begins on Thursday.

On Friday, expect New Zealand retail sales, UK GfK Consumer Confidence, and Japan’s CPI. The week culminates with Jerome Powell’s speech at Jackson Hole, which is likely to heighten market volatility and set the tone for the coming days.

Long-term sentiment

Following strong US economic numbers (labor market, retail sales, CPI), the market has calmed, and sentiment has shifted into a positive RiskOn mode (see more on waves statistics). However, the market remains in a defensive stance, trying to fend off recession fears, so it’s likely to scrutinize any macro data for signs of an economic downturn. While this week’s macro calendar is light, the following week will present a significant test for the current positive sentiment with major data releases.

Good luck! Team moodix!