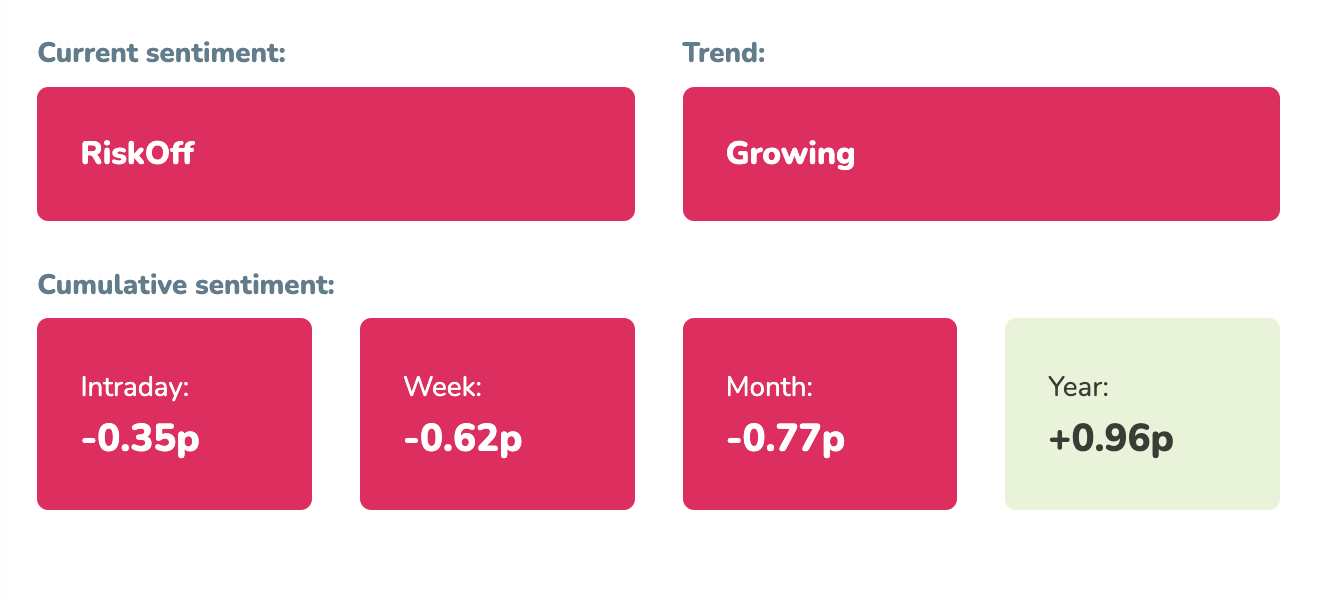

Market sentiment: RiskOff – 15 days

Recap of the past week:

The past week witnessed even deeper decline in market sentiment indicator. The S&P 500 shed 5% last week and is now approximately 7% off its all-time high (futures). The earnings results from Google two weeks ago hinted at the difficulties BIGTECH would face, which was confirmed as major tech companies like Amazon, NVIDIA, and TSMC dropped over 10%. Markets were also gripped by fears of an impending recession, underlined by the Fed’s somewhat panicked admission of a potential rate cut in September. This led to negative reactions, with significant drops following each major macroeconomic release (e.g., ISM, NFP). The market has completely abandoned the “Trump trade,” and Trump’s clear victory (post-assassination attempt) has transformed into a hard defense against Harris.

Outlook for the following week:

Let’s have a look at the following week from the economic calendar perspective.

The typically calm first week of the new month starts with the biggest macro day of the week, ISM services. Before that, we’ll get China’s PMI services, Sentix Investor Confidence (August), updates on EU PMI Services, and a speech by Fed’s Daly (we anticipate many Fed comments this week to calm the situation).

On Tuesday, the RBA rates decision is due (no change expected but could surprise), along with German and European Factory orders and the US Trade Balance.

Wednesday starts with unemployment data from New Zealand, China’s Trade Balance, and German Industrial Production. During the US session, we’ll see Canadian PMI, the US 10Y debt auction, and US Consumer Credit Change (June). After the close, earnings from Amgen Inc., Caterpillar Inc., and Uber Technologies, Inc.

Thursday focuses on RBNZ’s inflation expectations (New Zealand), the US weekly labor market overview, and the US 30Y debt auction. Notable earnings include Novo Nordisk A/S, The Walt Disney Company, Sony Group Corporation, CVS Health Corporation, and Shopify Inc.

The week concludes with Chinese and German inflation and the Canadian labor market data.

Long-term sentiment

The negative Moodix RiskOff sentiment is entering its third week riding on negative wave (see more on waves statistics), having accurately detected a broader market downturn. This is the strongest negative sentiment since last fall 2023.

Everyone is now wondering when this wave will end. Unfortunately, it appears we still have a long way to go. Last fall’s RiskOff wave lasted over a month, and Moodix has recorded RiskOff waves lasting up to two months. It’s futile to speculate about the low point now. The current situation is primarily driven by fears of a recession (plus uncertainty around US elections, Israel, and developments in China). The fear of a global recession is the main concern, with markets immediately looking to the Fed (and the argument that rates haven’t been cut yet). Until the nature of the recession is clarified, we cannot expect markets to return to growth. We anticipate the market will be heavily influenced by all macro data. Further deteriorations will push markets lower, and potential rate cuts won’t help (as they are already partly priced in).

Ongoing earnings reports also fall under macro considerations. The best (tech earnings) are behind us, and the market will scrutinize other sectors rigorously. Moodix trading systems will seek out short trades on potential DIP rebounds.

Good luck! Team moodix!