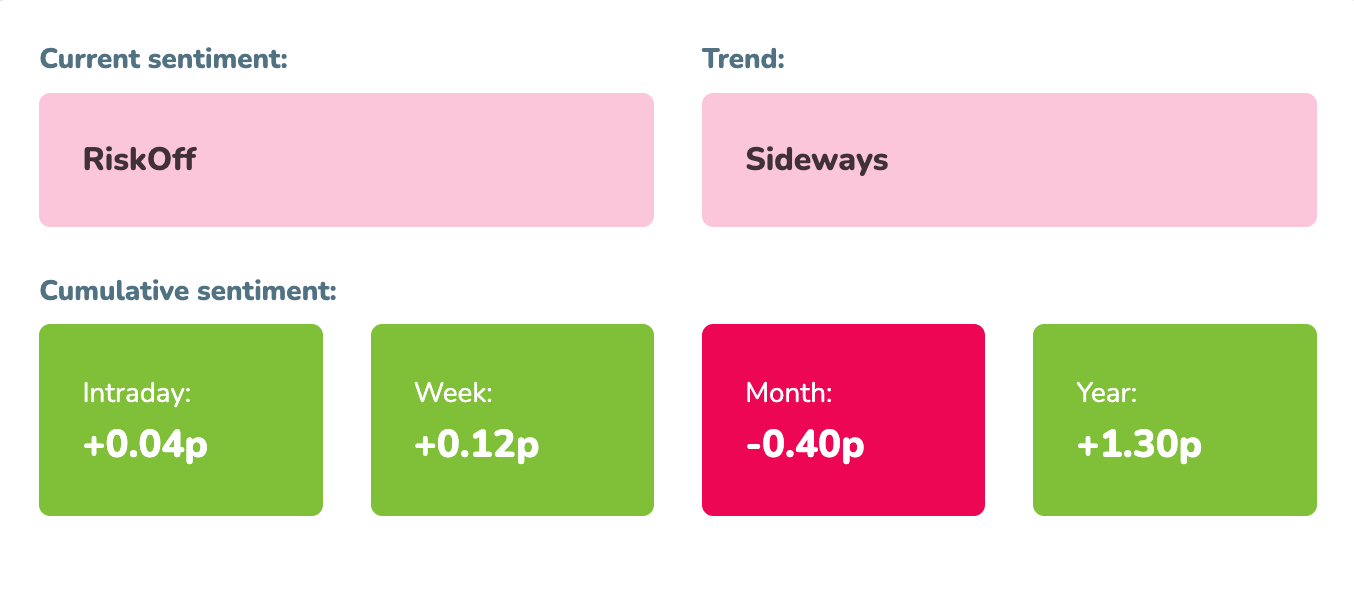

Market sentiment: RiskOff – 11 days

Recap of the past week:

The past week brought a noticeable improvement in market sentiment. Investors were bracing for another CPI decline, which would have fueled negative sentiment and the notion that the market was heading towards a recession. However, inflation growth, while not ideal for the Fed, indicated solid economic activity. This helped support the markets, bringing them back to levels seen in the previous week. Looking at the weekly sentiment trend (see below), it’s clear that the market has weathered the worst, and now it’s the Fed’s turn to act. Market sentiment indicator stayed in RiskOff territory.

Outlook for the following week:

Let’s take a look at the week ahead from the economic calendar perspective.

After a month-long break, central bankers are back in the spotlight, and this will dominate the entire week.

On Monday, the NY Empire State Manufacturing Index (Sep) is the only notable event. The market will be watching to see if the recent growth trend continues.

Tuesday kicks off with the highly anticipated Germany’s ZEW sentiment index. All its components have been declining for several months, and if the September data confirms this, it could be perceived quite negatively by the market. During the US session, we’ll see Canadian inflation, US retail sales for August (with expectations of confirming the strong 1% growth seen in July), as well as US industrial production (MoM) and capacity utilization figures for August.

Wednesday, the main macro day of the week, begins with UK CPI/PPI. Expectations are for stagnation or growth. If inflation rises, it will be interesting to see how the market reacts to the additional inflationary pressure (after the US CPI and PPI reports). Later in the afternoon, the Fed will announce its interest rate decision. A 0.25% rate cut is widely expected (a 0.50% cut is seen as very unlikely), and this has already been priced in by the market. Much more important will be Jerome Powell’s press conference afterward, where we expect to hear more details on the Fed’s plans, especially regarding the remaining two meetings this year.

On Thursday, we’ll start with New Zealand’s GDP (with an expected QoQ contraction of -0.3%) and Australian employment data. During the European session, the Bank of England is expected to keep rates unchanged but with a tighter vote split. In the US session, we’ll get the weekly jobless claims report, the Philadelphia Fed Manufacturing Survey (Sep), and the Existing Home Sales Change (MoM) for August.

Friday’s focus will be on Asia. Overnight, we’ll receive the UK GfK consumer confidencereport, Japanese inflation, and the Bank of Japan’s interest rate decision. Inflation is expected to rise, so it will be intriguing to see how the BoJ justifies holding rates steady (especially after raising them in July for the first time in years). We’ll also see the PBoC’s interest rate decision (no changes expected). Later in the day, we’ll get UK retail sales, Canadian retail sales, and EU consumer confidence (September).

Long-term sentiment

The current negative RiskOff market sentiment has sent the first signal of its possible end (see more on waves statistics). The second wave of negation suggests that it is already losing strength:

The core issues behind the previous market downturns remain unresolved. In our view, these are mainly due to deteriorating macro conditions (US labor market/manufacturing figures, and the EU data as a whole) and challenges in the outlook for the tech sector. None of the reasons for the market’s prior declines have been eliminated, which is a source of significant concern. As a result, we are cautious about the market’s direction in the upcoming week. However, we’ll be looking for the first long trades as the RiskOff wave comes to an end, particularly after any DIP corrections, aiming to capitalize on the euphoria from the Fed’s first rate cut (despite the fact that this is already priced in).

Good luck! Team moodix!