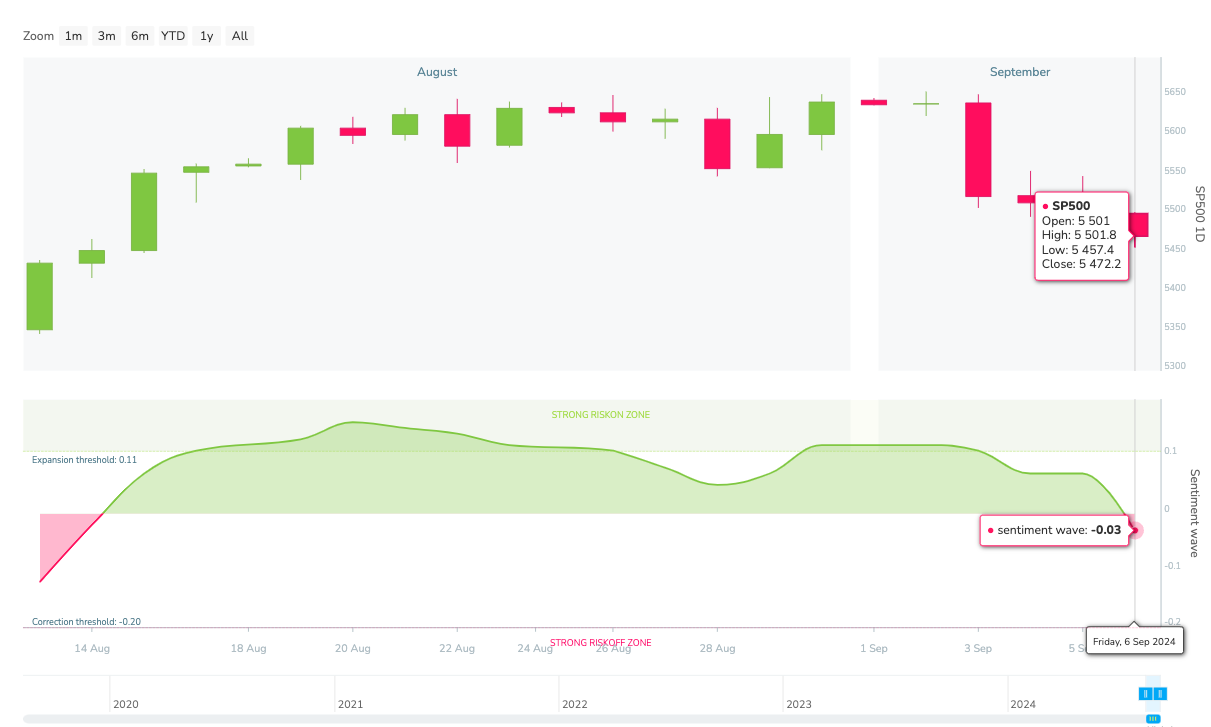

Market sentiment: RiskOff – 4 days

Recap of the past week:

The past week was marked by anticipation of new U.S. labor market data. Friday’s NFP results were not disastrous, but revisions, JOLTS, and ADP combined painted a slightly negative picture, confirming a gradual deterioration in job conditions. Markets are increasingly convinced that at least a mild recession is on the horizon. This have been hidden in the reactions to comments from Fed officials. Instead of calming the markets, their comments had the opposite effect, with investors reading between the lines and fearing deeper trouble ahead. As a result, the market sentiment indicator shifted from positive RiskOn to negative RiskOff.

Outlook for the following week:

From the economic calendar perspective, we have quite a loaded week ahead.

Monday will be relatively slow, but Japan’s Q2 GDP update, China’s inflation data, and the European Sentix index for September could still stir markets. Later, Apple will unveil its new iPhone lineup, though no surprises are expected as most details are already known.

On Tuesday, the action picks up with Australia’s Westpac (Sept) and China’s Trade Balance. Europe will see updates on Germany’s CPI and UK labor market data. In the U.S., only the NFIB Business Optimism Index (Aug) and the 3Y debt auction are due. After market close, the first round of presidential debates between Harris and Trump is set to take place, potentially offering significant insights.

Wednesday is the week’s macro highlight, with another batch of UK data: GDP, Industrial Production, Manufacturing Production, and Trade Balance. The U.S. will reveal its key macro data – CPI, expected to remain unchanged MoM at +0.2%, with YoY inflation dropping further to 2.6% from 2.9%.

Thursday starts with Australia’s inflation expectations, followed by the eagerly awaited ECB rate decision in Europe. A 0.25% cut is expected, though some speculate a bolder 0.5% reduction. The U.S. will release its weekly labor market overview and fresh PPI figures (a modest rise is anticipated). Before the close, we’ll also get the monthly Budget Statement update for August.

Friday kicks off with New Zealand’s Business PMI (Aug), followed by EU Industrial Production and the main macro event of the day: the first estimates for the Michigan Consumer Sentiment Index for September.

Long-term sentiment

Moodix market sentiment shifted to negative RiskOff from Thursday to Friday (see more on waves statistics). This was driven by incoming negative macro data, the ongoing correction in the TECH AI sector after Nvidia’s earnings, and somewhat unclear communication from the Fed. The S&P 500 fell by 4.2%, and the market now faces a critical question: will we test the August lows, or will the declines halt? There is currently little support for a fresh rally, as most macroeconomic data is deteriorating to some extent, and the market will require a new catalyst for upward movement.

Our view is that the market will start the week digesting the declines from the previous week and waiting for new data. Monday’s focus will be on Apple’s iPhone launch, while Tuesday’s presidential debate between Harris and Trump could provide surprises. Should Harris emerge victorious, it might bring some calm to the markets. The sentiment established early in the week will likely guide market behavior for the rest of the week. A potential trouble spot is the U.S. CPI. If it continues to drop, markets may not react significantly, but if it rises, it could hinder the Fed’s deeper rate cuts. Given the current (albeit weak) RiskOff sentiment, we’ll be looking for short trades.

Good luck! Team moodix!