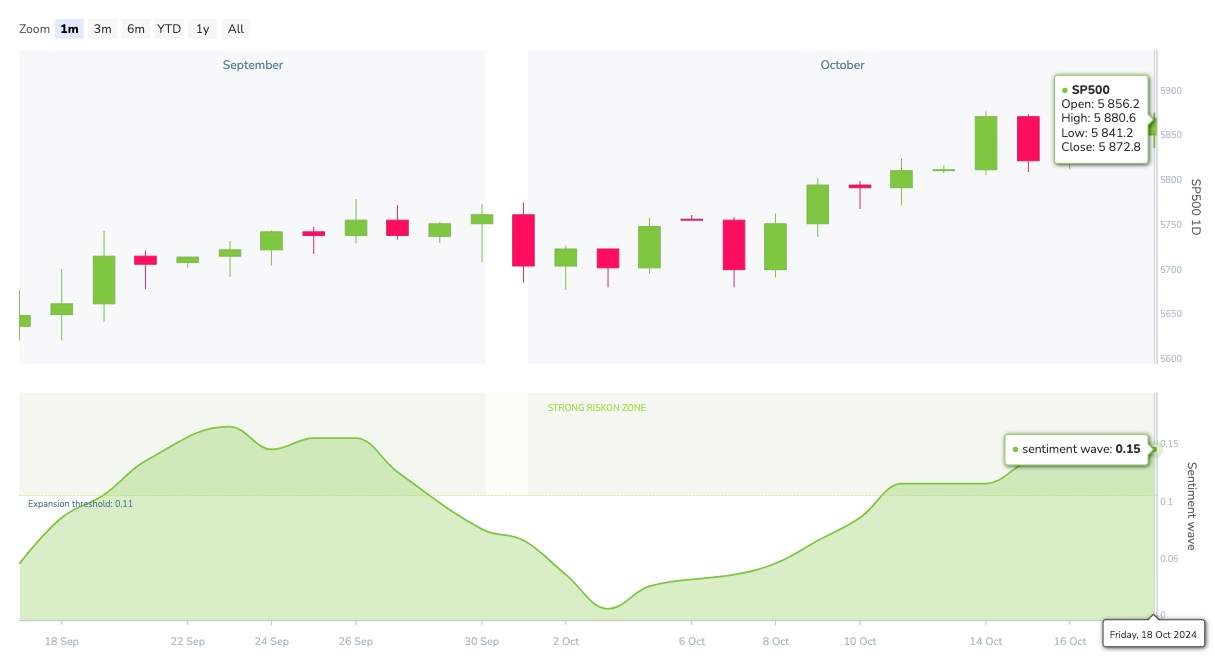

Market sentiment: RiskOn – 34 days

Recap of the past week:

The past week was marked by disappointment in ASML’s earnings, which affected the entire chip sector. The sector recovered only after TSMC delivered outstanding results. Netflix and several financial sector companies also surprised positively. Overall, the financial sector has delivered strong positive surprises so far. Otherwise, it was a relatively quiet week, with the main geopolitical event being the killing of a Hamas leader, which the market only reacted to with a drop in oil prices. Market sentiment indicator remained in positive RiskOn territory:

Outlook for the following week:

Let’s have a look at the following week from the economic calendar perspective.

Monday’s calendar is almost empty. During the Asian session, we expect an interest rate cut from China’s central bank, with speeches from Fed members coming at the end of the session. We will also see earnings from Germany’s SAP SE on Monday. Additionally, the IMF begins its multi-day meeting.

Tuesday will once again feature a light macro calendar, but this will be offset by speeches from nine central bankers from the ECB, BoE, and Fed. The day will also bring interesting earnings reports, such as those from General Electric, Philip Morris International, Verizon Communications, Texas Instruments, and Lockheed Martin.

Wednesday also has a sparse calendar, but we will see Canadian interest rates, EU Consumer Confidence, US Existing Home Sales, and the Fed’s Beige Book. The day will be filled with more central banker speeches, and Tesla’s much-anticipated earningsreport will come after the close.

Thursday, the key macro day of the week, will bring the first estimates of October PMI surveys from the largest economies. The manufacturing index, for example, has been steadily declining in Germany since June and in the US since August. The market will be looking for improvements, and if they materialize, we could see a push beyond current all-time highs. The services sector is less crucial, as most indicators remain above (or around) the 50-point expansion threshold.

Friday will be more active in terms of macro data, with UK Consumer Confidence and Japan CPI during the Asian session. In the EU, we’ll get Germany’s IFO, Canadian Retail Sales, US Durable Goods Orders, an update on the Michigan Consumer Sentiment Index, and the UoM 5-year Consumer Inflation Expectation.

Long-term sentiment

The current RiskOn sentiment has an above-average duration of 34 days (see more on waves statistics). A tepid close on Friday may indicate that the market will likely defend its positions near all-time highs and trade sideways early in the week. This week will be dominated by earnings, with only the PMI data having the potential to disrupt the current sentiment. Developments in Israel are showing de-escalation tendencies, and retaliation remains out of sight for now. We continue to seek long trades within the RiskOn sentiment.

Good luck! Team moodix!