Market sentiment: RiskOn fading

Recap of the past week:

Last week, markets were still digesting the substantial gains from the prior “Trump trade” rally as they awaited the release of U.S. CPI. While the CPI data wasn’t outright negative, a wave of Fed member comments hinted at the possibility of no rate cut in December. Notably, Jerome Powell’s remarks provided little reassurance to the markets. Meanwhile, Donald Trump began unveiling his administration’s nominations, which raised concerns, especially regarding future relations with China. By Friday, disappointing macro data from both China and the U.S. sealed the week’s fate. Below, we’ve highlighted the top themes weighing on the financial markets. Market sentiment indicator shifted into RiskOn fading territory.

Outlook for the following week:

Let’s have a look at the following week from the economic calendar perspective:

Monday will focus on central bank commentary from the BoJ, ECB, and Fed, accompanied by discussions at the G20 summit, where Donald Trump is expected to weigh in, significantly influencing markets.

Tuesday’s calendar is relatively light, with the G20, Canadian inflation, and Walmart earnings likely dominating attention.

Wednesday is thin on macro data but brings the highly anticipated earnings report from Nvidia after the U.S. market close, which is expected to impact the entire TECH sector. Additionally, China’s interest rate decision, Germany’s PPI, and UK CPI/PPI updates will also be on the radar.

Thursday, the most macro-heavy day, will deliver the usual U.S. weekly job market data and the closely watched S&P PMI. Particular scrutiny will be on the manufacturing component to see if last month’s expansion above 50 points can be sustained.

Friday will feature the first flash PMI estimates for November from major economies, with European markets eager to confirm October’s growth. Any disappointment could further pressure the euro and ECB. U.S. session highlights include Canadian Retail Sales and an update on the Michigan Sentiment Index.

The distribution of likely peak activity in the figure below:

Long-term sentiment and Outlook for following months

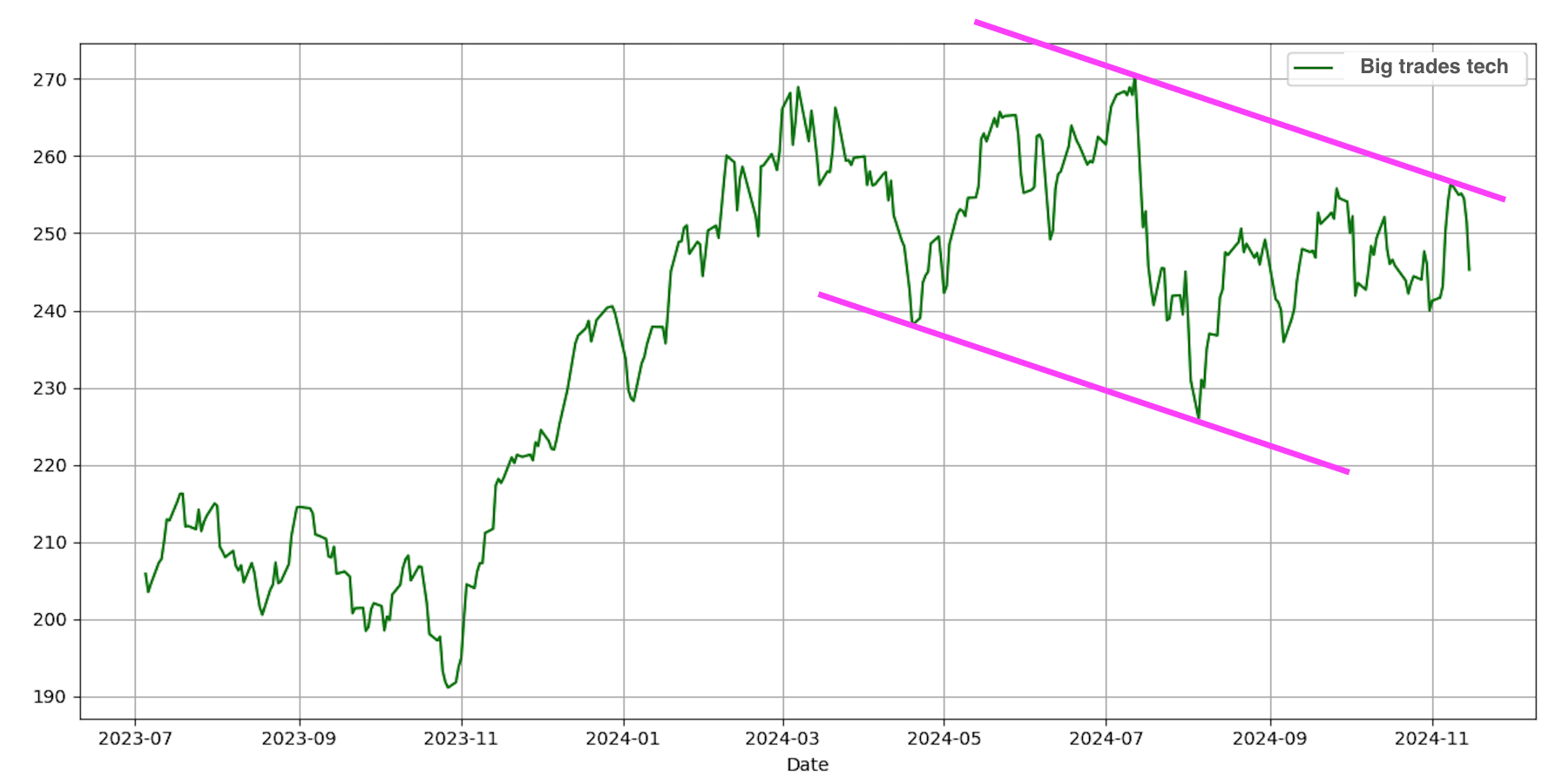

From a Moodix perspective, last week significantly shifted market sentiment (see more on waves statistics). The post-election exuberance has faded, as markets re-evaluate Trump’s nominations, which have sparked both skepticism and concern, particularly around TradeWars implications. The TECH sector, in particular, is under scrutiny, with major players like TSMC, Nvidia, and Qualcomm facing mounting challenges. Maintaining valuations in the sector seems increasingly difficult, as shown in the chart below, which shows a TECH segment consisting of single trades of the underlying (stock) without small orders:

The chart reveals the TECH sector has been moving sideways in terms of large-scale trades since March 2024. The classic chart of the tech sector then looks like this:

For upward momentum to resume, the sector needs strong positive catalysts. Could Nvidia’s Q3 results provide the push? Possibly, but it’s unlikely to suffice without clarity on U.S.-China trade relations—a resolution that appears improbable before Trump’s inauguration. Until then, Trump’s rhetoric may escalate as he positions himself for negotiations.

Furthermore, the Fed’s uncertain stance following recent CPI and PPI data adds to the unease. Jerome Powell remains at odds with Trump, creating a tense dynamic. Trump, ever the shrewd negotiator, might sacrifice market stability pre-inauguration by intensifying TradeWars rhetoric, possibly blaming Biden.

Market sentiment, which had soared to extreme levels post-election, began to deteriorate on Friday, signaling the end of the current RiskOn wave. Should Trump and his administration hold back on aggressive remarks, the S&P 500 may range between 5800 and 6000 points (ES futures) in the coming week. Otherwise, a drop toward 5700 points shouldn’t be ruled out. We are currently out of the markets and waiting for further developments.

Good luck! Team moodix!