Market sentiment: RiskOff – Sideways

Recap of the past week:

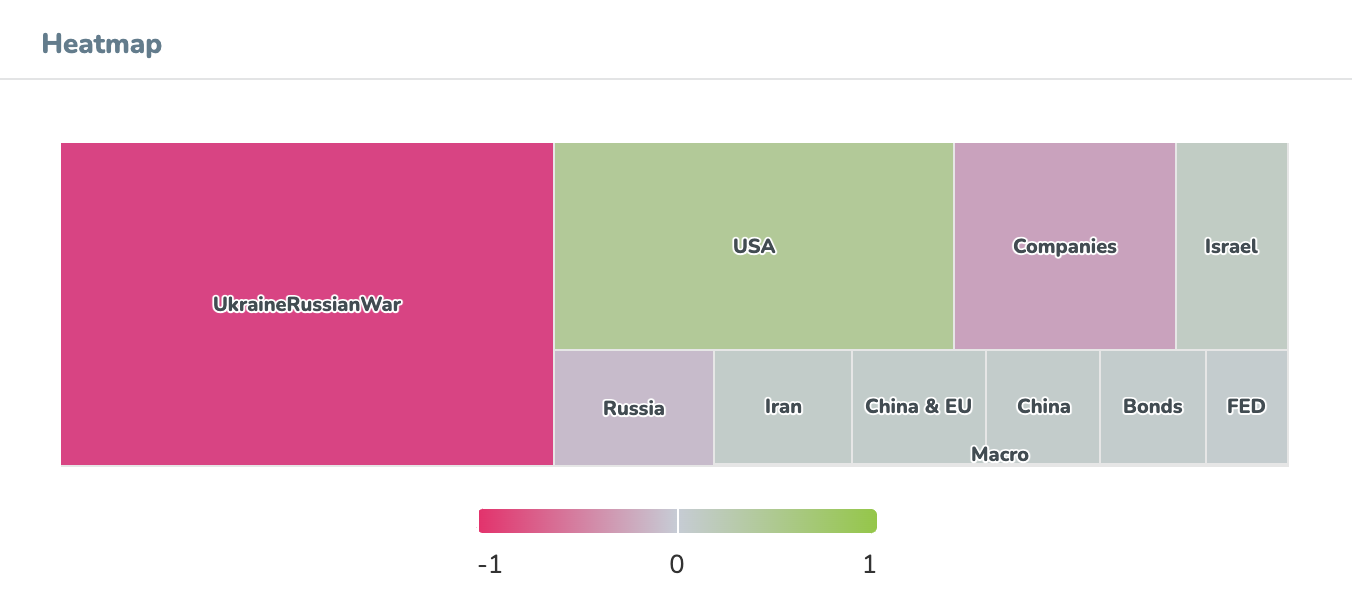

As illustrated in the heatmap of last week’s key topics, the week was dominated by the escalating Ukraine-Russia conflict. This overshadowed what should have been the focus: Nvidia’s earnings and PMI data. Nvidia reported excellent results, though the market’s negative reaction was attributed to a slightly tempered—but still strong—outlook. Meanwhile, terrible PMI data from Europe contrasted sharply with stellar PMI figures from the United States, which helped offset losses incurred from the conflict’s escalation. Market sentiment indicator shifted into RiskOff – Sideways.

Outlook for the following week:

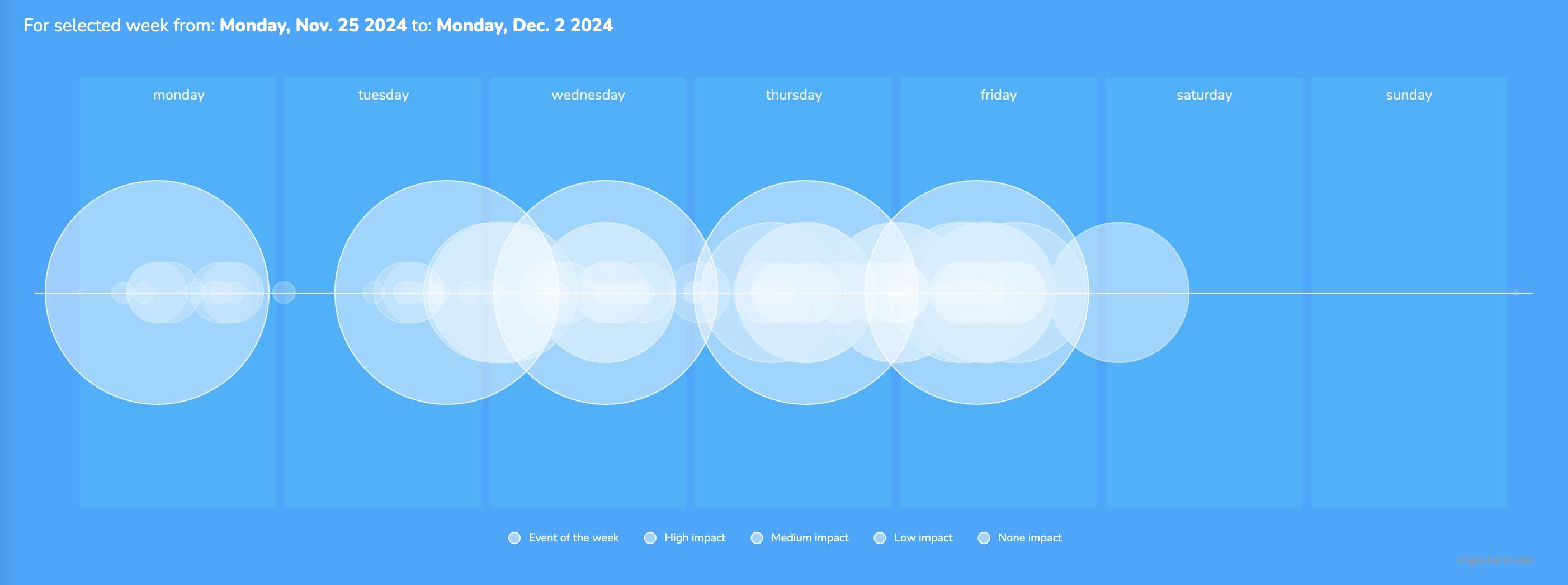

Let’s have a look at the following week from the economic calendar perspective. We anticipate a gradual start to the week.

Monday will likely be spent digesting the developments of last week and the weekend, with the German IFO Index being the main highlight during the European session.

Tuesday is set to follow a similar pattern, but the US session will feature important releases, including US Consumer Confidence, Home Sales data, and the FOMC minutes. Markets will scrutinize these minutes for potential clues on the Fed’s next steps, including the possibility of a rate cut in December. After the market close, the final earnings reports from the tech sector will arrive (DELL, CRWD amongst others).

Wednesday is the pivotal macro day of the week. The action kicks off in Asia with the Reserve Bank of New Zealand (RBNZ) expected to cut rates by 0.5%. Europe follows with the German GfK Consumer Sentiment Index. The US session will be packed, as data releases have been rescheduled due to Thanksgiving. Key reports include PCE indices (quarterly and monthly), weekly labor market overviews, an update on Q3 US GDP, Durable Goods Orders, and the Chicago PMI. The PCE data will be especially critical—any upward deviation would likely be interpreted as evidence of stagnation in inflation’s decline.

Thanksgiving in the US won’t leave markets idle. On Thursday, Europe will see a fresh wave of inflation figures, starting with Spain, followed by German federal states, culminating in the national German CPI figure. Other notable data include Business Climate, Consumer Confidence, and the Economic Sentiment Indicator.

Friday begins with CPI and Retail Saless from Japan. The European session brings German Retail Sales, CPI figures from France, Spain, and the EU, Swiss GDP, and finally, Canadian GDP, given a quiet US calendar.

The distribution of likely peak activity in the figure below:

Long-term sentiment

The upcoming week is marked by the Thanksgiving holiday on Wall Street, a period often associated with the unofficial start of a festive mood in financial markets. Unless some extreme shocks like last week’s Russia-related escalation occur, markets are likely to continue paring back the negative sentiment from the previous week.

The deteriorating sentiment sparked a RiskOff wave last week (see more on waves statistics). However, this wave has been notably weak and began fading almost immediately. On Thursday, our systems picked up the first signals for entering positions (current sentiment surpassed the five-day average; specific signals are provided HERE). If sentiment does not worsen further, we’ll continue seeking long trades.

Good luck! Team moodix