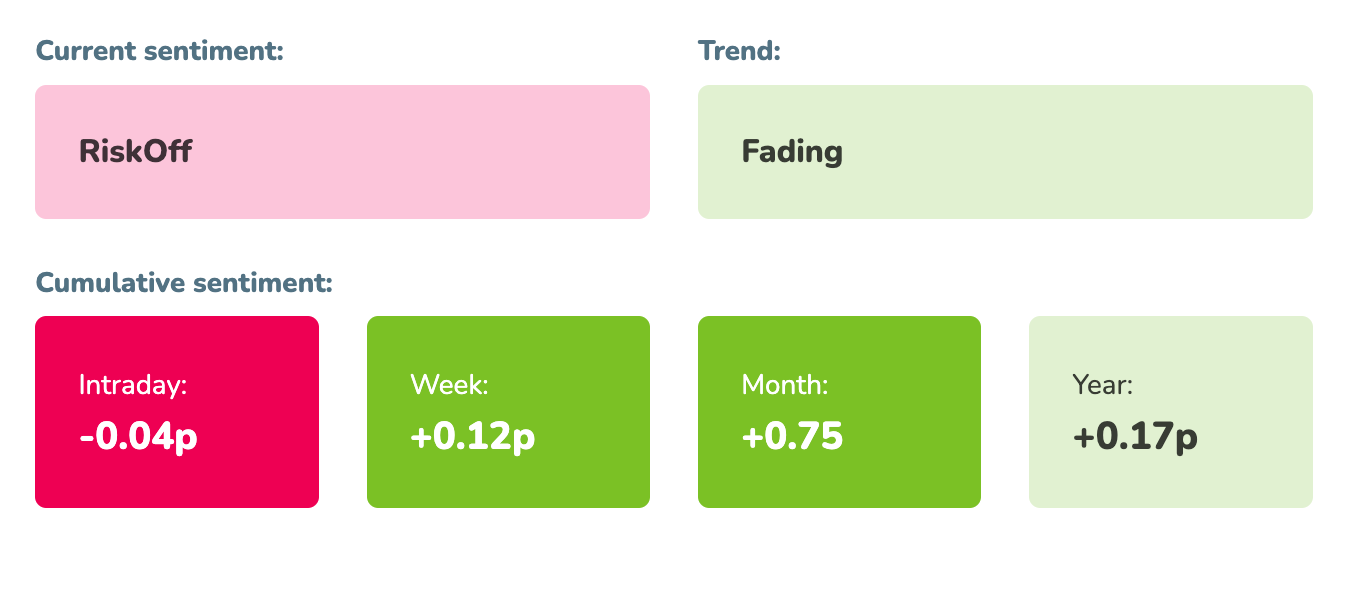

Market sentiment: RiskOff 5 days

Recap of the past week:

The ending week was marked by anticipation of Nvidia’s results. They delivered literally unbelievably shocking figures, surpassing all possible expectations. The RiskOff sentiment thus came under pressure again, and the TECH segment pulled the S&P 500 up a bit further. Apart from that we witnessed a relatively calm week with the absence of major macro news.

Outlook for the following week:

In contrast to relatively calm week the following one will definitely not be boring. We can call it “the week of inflation data.” Let’s take a look at the individual days and macro data that are likely to impact Moodix index.

On Monday, we’ll start slowly as the market will wait “just” for the US5Y and US2Y auctions.

Tuesday will bring January inflation figures in Japan, German GFK, and US Durable Goods Order, and a speech by FED’s Barr. Then US Consumer Confidence, Richmond Fed Manufacturing Index, and Dallas Fed Manufacturing Business Index (February readings). The day will end with closely watched US7Y auction.

Wednesday will start with Australian CPIs followed by New Zealand rates decision including a press conference. During the EU session we’ll see Swiss ZEW, Economic Sentiment Indicator, Industrial Confidence, Consumer Confidence, Business Climate, Services Sentiment (all for February). The US session will bring an update of US GDP for Q4, Personal Spending/Income, and Core Personal Consumption Expenditures. At the end of the day we’ll spend some time with FED’s company, namely Bostic, Collins, and Williams.

Main macro day of the week is Thursday which is also the last day of February. There’s a lot on menu. During the Asian session we’ll get Japanese Industrial Production, Japanese Retail Sales, and Australian Retail Sales (all for January). During the EU session then German Retail Sales (January), French CPI (February), Swiss GDP Q4, Spanish CPI, German Unemployment, and German CPI for February. US session will bring the macro of the week: PCE Index, weekly overview of the labor market, home sales, Kansas Fed Manufacturing Activity (February).

Friday’s gonna be pretty interesting as well – we’ll se Chinese PMIs, speech by FED’s Williams, Swiss Retail Sales, update of EU PMIs for February, and EU CPIs for February. During the US session, we await a hefty dose of strong readings. Update of US PMIs and individual components of ISM including inflation projections, that might be particularly interesting.

Throughout the week, we expect headlines about developments in Gaza. Current development suggest a preliminary agreement is emerging. However, the Israeli declaration regarding the release of hostages before the beginning of Ramadan still stands.

Long-term sentiment

As you can see in the image below, thanks to the Fed and the US labor market, the positive RiskOn showed by market sentiment indicator has deteriorated significantly. It has lasted for 40 days and thus belongs among the longer ones. Interestingly, such a long positive sentiment traded on the SP500 within a mere 170p range and thus did not provide too many trading opportunities. The future development will be decided by Wednesday’s CPI, and trading systems will be turned off until then; a decision on further course will be made after those figures are received.

Good luck! Team moodix!