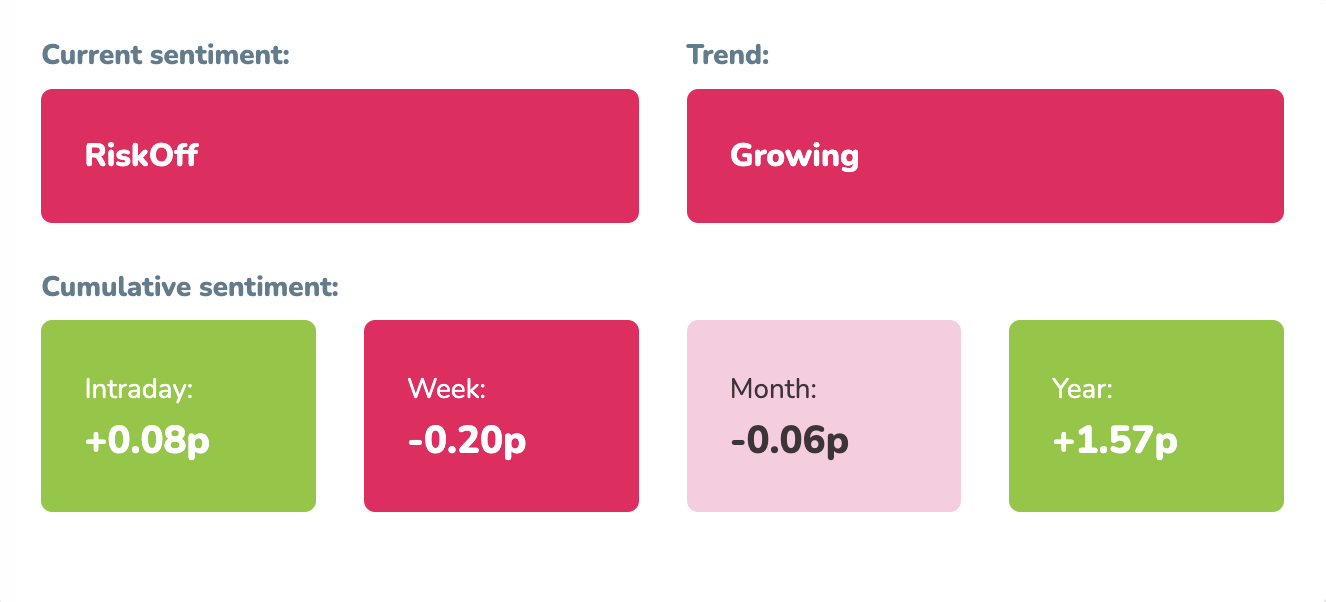

Market sentiment: RiskOff – 8 days

Recap of the past week:

The past week witnessed a further decline in market sentiment indicator . The primary drivers of this downturn were the disappointing tech earnings, particularly Google’s. The main issues were rising costs and the lack of evidence for potential returns from AI investments. However, the US Q2 GDP report provided a significant boost, helping the market recover some losses from earlier in the week. Throughout the whole week, the turbulent US presidential election situation continued to influence the markets, with enthusiasm for the “Trump trade” gradually fading.

Outlook for the following week:

Let’s have a look at the following week from the economic calendar perspective.

Monday will kick off a very challenging week with an almost empty calendar, featuring only McDonald’s earnings. The escalating situation in Israel (with a growing likelihood of intervention in Lebanon) is expected to impact the markets.

Tuesday marks the start of a packed week. We’ll see the initial estimates of European Q2 GDP, the first estimates of German inflation, and the initial US labor market data, specifically JOLTS. After the close, we will have crucial earnings reports from Microsoft and AMD.

Wednesday, the main macro day of the week, begins in Asia with Chinese PMI and Japanese rate decisions. The market will be looking for hints of a possible rate hike, although no increase is expected from the BoJ at this time. In Europe, we will monitor the Swiss ZEW and EU-wide CPI. In the US, we’ll get more labor market data, specifically ADP, and the Chicago Purchasing Managers’ Index. Later, the Fed’s rate update is expected (no change anticipated until September), and the press conference will be closely watched for assurances regarding a potential rate cut in September. After the close, we’ll see more key earnings from the MAG7, specifically META, along with Qualcomm, ARM, and others.

Thursday brings PMI updates from the largest economies, with a particular focus on China and Germany. The Bank of England is expected to cut rates, followed by comments and an outline of future steps. In the US, we’ll get the weekly labor market overview and the closely watched ISM Manufacturing Index. All eyes will then turn to Apple’s earnings, with no major surprises expected, as Apple’s primary market action typically begins in the fall. Continued iPhone declines, especially in China, are anticipated. We’ll also see Amazon’s earnings.

Friday’s focus will be on key labor market data, with the monthly NFP report. A significant figure of 185k is expected, though a number around 150k wouldn’t be surprising given the cooling observed in the weekly data. This would reinforce the market’s expectations for a September rate cut. Early in the day, we’ll see earnings from Alibaba, followed by Berkshire Hathaway Inc. after the close.

Long-term sentiment

We are heading into a unique week. Strong macroeconomic data and US labor market reports will coincide with Big Tech earnings. Given the weight of the Tech segment in the S&P 500 index, increased volatility is expected. The market will be very strict (as seen with Google) and will want to see clear results from AI and justification for current valuations. It was evident with Google how strict the market will be now. We expect Microsoft to meet expectations (having already achieved 6% from AI last quarter). META, Amazon and Apple will face significant challenges as AI profits cannot be counted on for them.

Another crucial factor is the Fed itself. The probability of a rate cut is very low, but we might see some confirmation of a September cut. Here, we expect a “Buy the Rumors, Sell the News” mode. Any hint of a cut could change market sentiment, leading to a decline due to recession fears. The current, relatively strong, RiskOff sentiment will undergo its first test this week (see more on waves statistics). If Big Tech doesn’t deliver what the market wants to hear, we could see another week of significant declines. Trading systems will be off until Wednesday, waiting for the data.

Good luck! Team moodix!