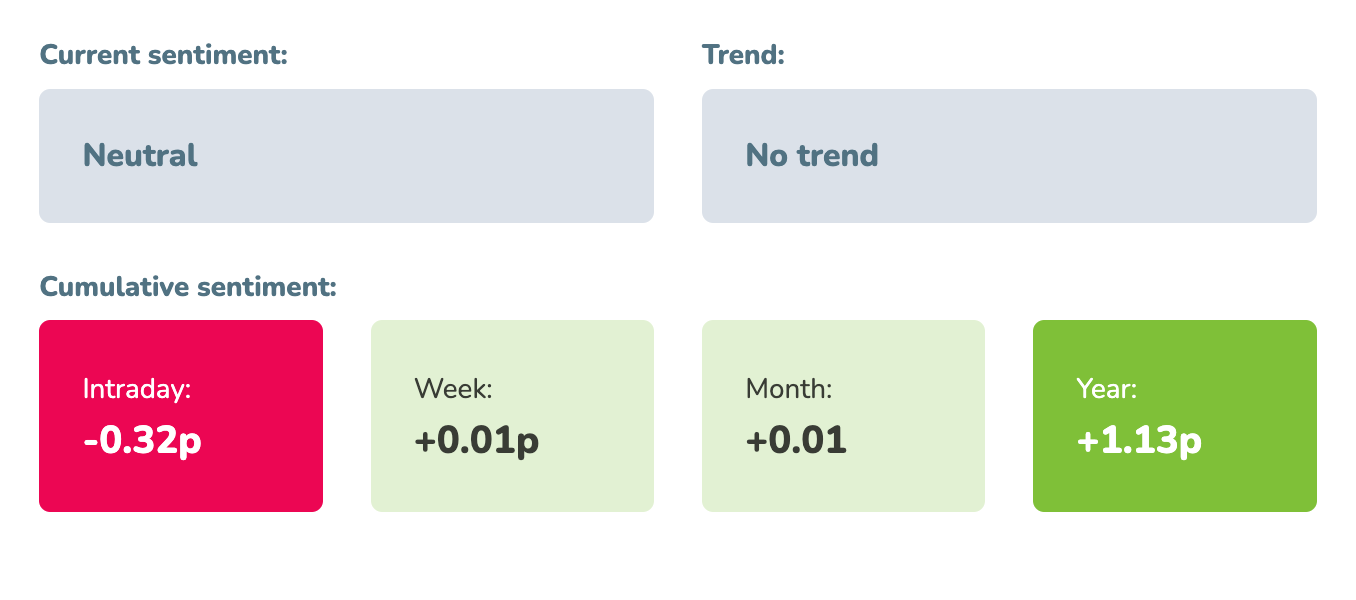

Market sentiment: Neutral 8 days

Recap of the past week:

The past week was marked by ECB rates and the US labor market. The ECB did not surprise and lowered rates by 0.25% as expected. The market was slightly surprised by the reduction in holdings of securities under the Pandemic Emergency Purchase Program (PEPP) by an average of 7.5 billion euros per month. Much more surprising was Friday’s NFP report, that shifted market sentiment indicator. In the US, 272k new jobs were created, and it certainly cannot be said that the labor market is cooling down.

Outlook for the following week:

From an economic calendar perspective, everything important will happen on Wednesday, when we will get inflation numbers from the US and then the set FED rates and the subsequent press conference… but gradually:

On Monday, the market will be digesting the European elections. At the time of writing, it looks like we are not expecting any major upheavals. Besides that, there will be Japanese GDP and Sentix Investor Confidence (June).

On Tuesday, we will only have labor market data from the United Kingdom.

On Wednesday, the main macro day of the week, we will first get China’s CPI in Asia (expected YoY +0.3%). In the EU, we will get an update on Germany’s CPI (no change expected) and a batch of data from the UK (Industrial Production, GDP, Manufacturing Production). Then, the US CPI will be the macro event of the week. No significant changes are expected here: MoM from 0.3% to 0.2% and CORE YoY from 3.6% to 3.5%. After that, we will have the FOMC meeting. No rate change is expected, but the subsequent press conference by Chairman Jerome Powell will be much more important. Since he will have fresh numbers available, this will likely be the main topic.

On Thursday, we will get fresh numbers from the Australian labor market and then more inflation numbers from the US, this time the PPI. A substantial decline is expected here, the first of this year. If it doesn’t happen, it will be a disappointment.

On Friday, we will get rates from the Bank of Japan, and the market expects no changes. The subsequent press conference will be more interesting. In the US session, we will get the first estimate of the Michigan Consumer Sentiment Index for June and its most-watched component recently, the inflation expectations.

Long-term sentiment

In the past week, the market rebounded from another correction attempt, and market sentiment didn’t even have time to dive into a new trend before returning to positive territory by Thursday (see more on waves statistics). On Friday, sentiment came under pressure again (thanks to the NFP), and we continue in a very unclear environment without a clear trend. We will see if this unclear environment finally breaks with Wednesday’s CPI and FOMC.

Good luck! Team moodix!