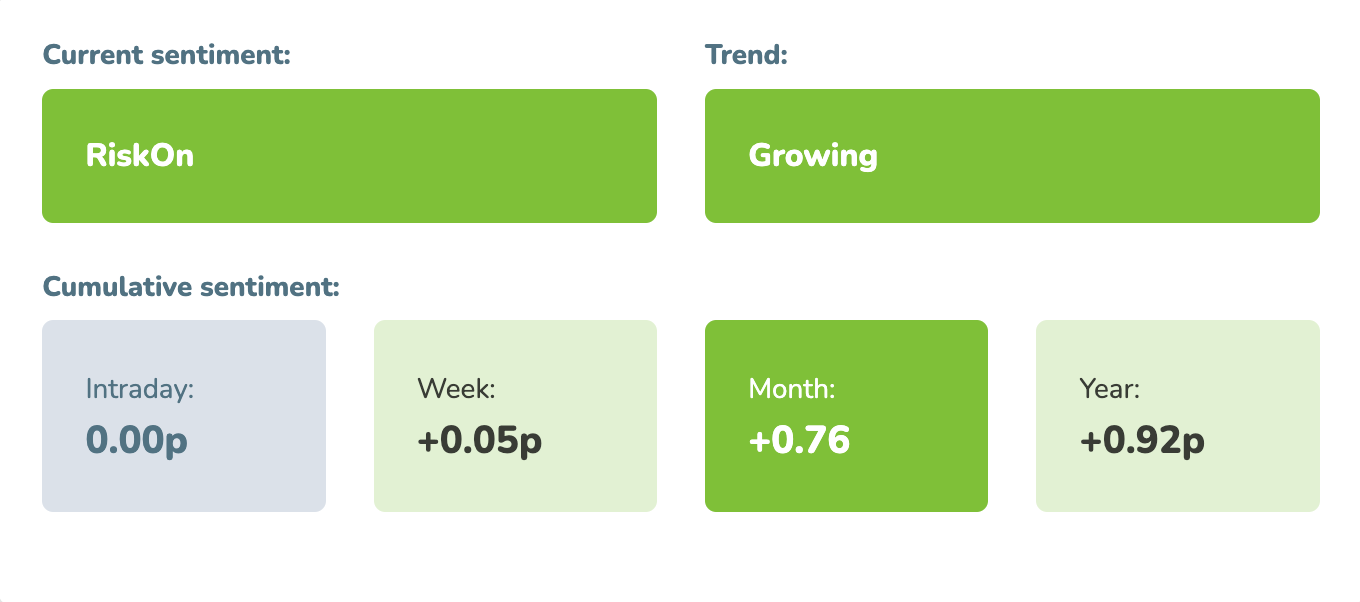

Market sentiment: RiskOn – 35 days

Recap of the past week:

As expected, the Easter week did not bring major changes to the market. It is worth mentioning the next US GDP recalculation, which brought another improvement and we can already look forward to the first estimates for Q1/24.

Friday’s Core Personal Consumption Expenditures figures fell as expected and the market will likely stay calm till the next US CPIs readings. This data were released during the closed markets on Friday and we have to wait until the market open to see its reaction.

The most interesting event from our perspective was the speech delivered by Fed’s Chair Jerome Powell at Macroeconomics and Monetary Policy Conference on Friday. We can describe the speech as relaxed, open and actually very dovish. We can only guess the market impact but from our point of view it was quite a market pleasing speech.

Outlook for the following week:

Our supplier of macro data is experiencing an outage, so this time the outlook for next week will be a bit shorter (moodix visual calendar be delivered to you during Monday).

On Monday, a significant part of the markets will still be closed, however, the US market will be open and that’s what matters. We’ll receive strong macro ISM Manufacturing PMI (growth is expected).

On Tuesday, we’ll get updates of EU PMIs for March and first estimates of German CPI. During the US session, we will start with data from the US job market, namely JOLTS. The rest of the session will be spend in company of FOMC members (Bowman, Williams, Mester, Daly).

On Wednesday during EU session we’ll get just fresh EU CPI data. A bit more loaded US session to follow with fresh piece to the US job market puzzle – ADP, S&P Global Services PMI, and ISM Non-Manufacturing PMI (Mar). Then we can look forward to another speech by Fed’s Jerome Powell.

On Thursday, there will be a public holiday in China and reduced Asian volatility can be expected. In the EU, we will only receive March service PMIs from the largest economies and a weekly overview of the US job market.

On Friday, the Chinese market holidays will continue with low volatility. However, in the afternoon, we will receive the macro week’s highlight: NFP. A strong growth around 200k is expected and likely a revision downwards from the previous month.

Long-term sentiment

The market is still riding the wave of positive sentiment. The current positive wave has been lasting for 35 days now. In 10 days, the earnings season begins, and the market, with its current valuations, is unlikely to embark on bigger adventures upward without strong fundamental impulses. We will be looking for long trades.

Good luck! Team moodix!