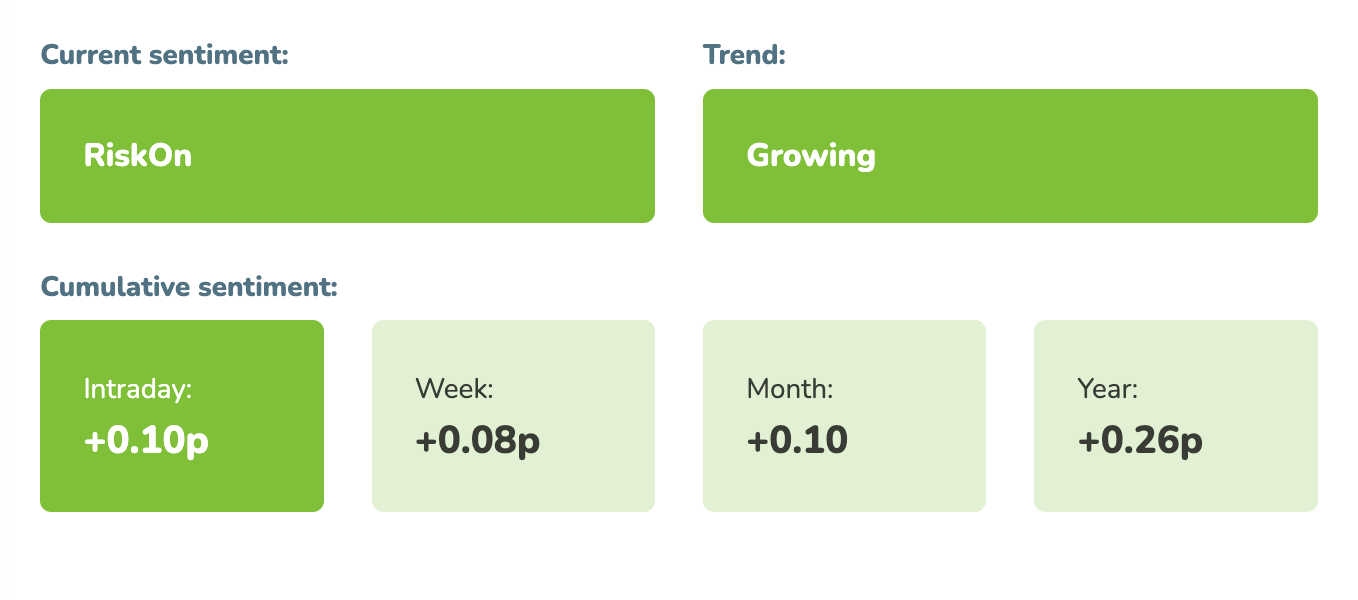

Market sentiment: RiskOn 6 days

Recap of the past week:

The ending week was marked by the release of fresh CPIs or other inflationary measures (US PCE) and heavy cadence of Fed’s members commentaries. I would like to mention especially one of the strongest negative news of the week from Goolsbee. It stated that if labor productivity continues to grow remarkably, the Fed will have to respond with higher rates or at least no cut at all in 2024. Thanks to other’s remarks and declarations, the market was in a “Bad News Is Good News” mode. See, for example, Friday’s ISM.

Outlook for the following week:

The week ahead will be marked by US job market data, ECB’s rates decision, and Jerome Powell’s testimony in the House of Representatives. Since it is the first week of the month, other data might be of “less important” nature. The market will rather look forward to the next week when we get the first March data.

On Monday, we’ll receive the most important data during the European session: Swiss CPI & March Sentix Investor Confidence. Then Japanese CPI after the market close.

Tuesday will be mostly about PMIs updates from all over the world. The main focus will be – as always – on the US readings, both from S&P and ISM. Furthermore, we will get US Factory orders (January) and Fed’s Barr speech.

On Wednesday we’ll kick off with Australian GDP Q4, EU Retail sales (January), and Canadian rates. Moreover, we’ll receive (exceptionally in one day) data from the US labor market. Both ADP and JOLTS. Closely watched Jerome Powell’s hearing in the House of Representatives (lasts 2 days!) gonna start on Wednesday. Before the market close, Fed’s Daly may have something to say, and we will get Fed’s Beige Book insights.

Thursday will start with Australian and then Chinese trade balance figures. During the EU session, first January German Factory orders, then ECB rates with press conference following. During the US session, a weekly overview of the US labor market and the continuation of Jerome Powell’s hearing in the House of Representatives.

And Friday, the main macro day of the week, will bring Japanese GDP Q4. In Europe then, German Industrial Production and PPI (all January) numbers, and EU GDP Q4. And finally US session’s macro of the week: NFP. It is expected 200k new jobs (prev. 353k). Getting such numbers, it would not yet be possible to speak of a cooling labour market.

Throughout the week, we will be supplied with headlines from Gaza. Yet another round of negotiations about a new ceasefire before the start of Ramadan are underway.

Long-term sentiment

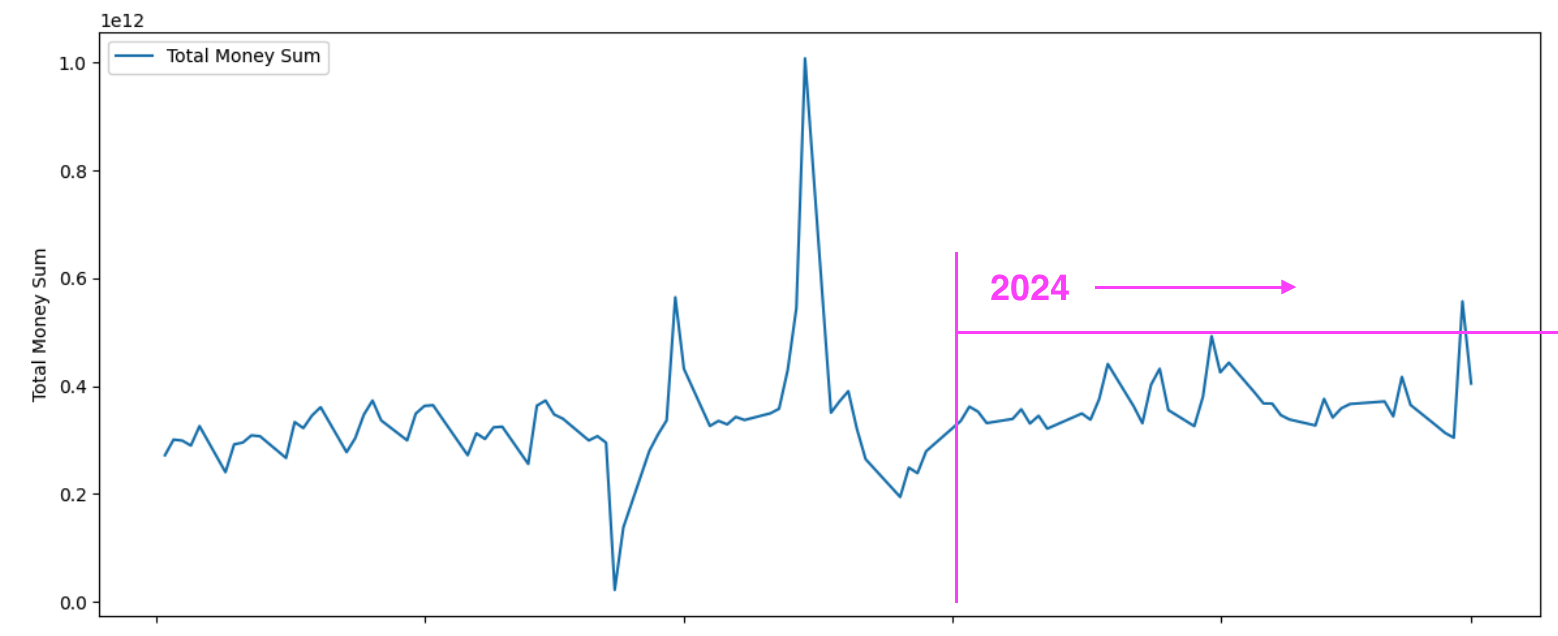

The measured Moodix market sentiment indicator has once again shifted into positive territory, and the market has fully absorbed negative US CPI data. The new tool in moodix web app is being prepared, True Volume (recalculation of individual trades of all S&P 500 stocks), which clearly indicates an ongoing rotation out of the TECH segment now and hence supports the idea that the S&P 500 at current valuations has not yet had the last word.

But, of course, it will depend on further developments. For instance, in March, we are facing the end of the emergency funding for US banks initiated a year ago during the banking turmoil. Nevertheless, we have a positive market sentiment, RiskOn, and trading systems will be seeking long trades.

Good luck! Team moodix!