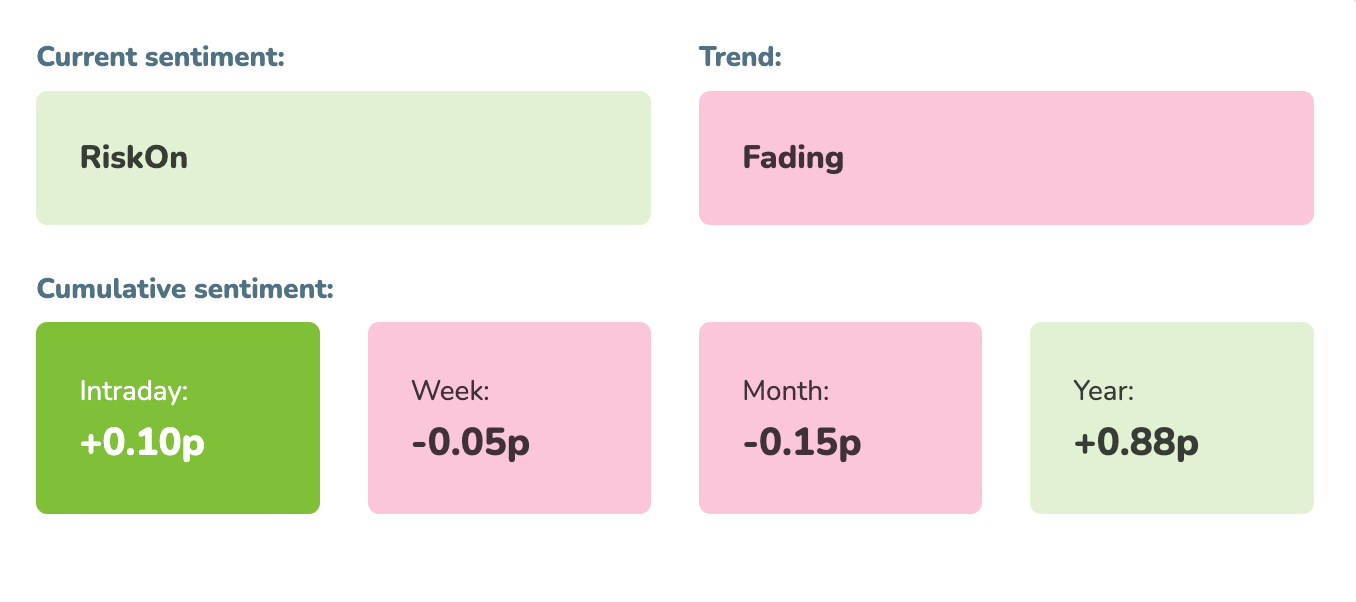

Market sentiment: RiskOn 42 days

Recap of the past week:

We´ve seen a week marked by crucial US labor market data and comments from Federal Reserve bankers. The labor market once again surprised with its strength, raising new questions about how the Fed will react to a potential further increase in inflation (fresh data this Wednesday). The same questions were undoubtedly addressed by Fed bankers. In statements during the week, they began to outline – for the first time – the possibility of proceeding with no cut at all this year or even with an additional hike (though very unlikely). These speculations broke a rather strong RiskOn sentiment for the first time in 40 days.

Outlook for the following week:

We are facing the main macro week of April. On Wednesday, we’ll get fresh US CPIs and on Friday, we’ll kick off the extremely important earnings season for Q1/2024. But let’s take it step by step:

On Monday, we have only German Industrial Production, European Sentix Investor Confidence, and SNB’s Chairman Jordan’s speech.

On Tuesday, during the Asian session, we will hear Fed’s Kashkari’s speech, the UK’s BRC Like-For-Like Retail Sales, and the European ECB Bank Lending Survey.

On Wednesday, the macro day of the week, we can look forward to New Zealand’s rates (no change expected) and then we get the macro of the month: US CPIs. The market expects an increase to 3.4% (from 3.2%) YoY and a decrease to 0.3% (from 0.4%) MoM. Core MoM the same and YoY decrease to 3.7% (from 3.8%). If we get this expectation, the market probably won’t be too thrilled, and will definitively erase the potential rate cut in May. The market would need a more substantial decline to reassured of the path to the target. Then we’ll get Canadian rates decision with subsequent press conference, Fed’s Goolsbee’s speech, the auction of US 10Y debt, and the FOMC minutes from the last FED meeting on top.

Thursday will kick off with Chinese inflation figures. In Europe, we’ll then get ECB rates (no change expected) followed by press conference. In the US, fresh US PPIs, Fed’s Williams’s speech, the auction of 30-year US debt, and Fed’s Bostic’s speech.

Friday to start with the Chinese Trade balance in Asian session. In Europe we’ll see an update on German CPI for March, UK GDP and Industrial Production. In the US, the first estimates of the Michigan Consumer Sentiment Index for April and especially the beginning of Q1/2024 earnings season, starting with banks before the US markets open.

Long-term sentiment

As you can see in the image below, thanks to the Fed and the US labor market, the positive RiskOn showed by market sentiment indicator has deteriorated significantly. It has lasted for 40 days and thus belongs among the longer ones. Interestingly, such a long positive sentiment traded on the SP500 within a mere 170p range and thus did not provide too many trading opportunities. The future development will be decided by Wednesday’s CPI, and trading systems will be turned off until then; a decision on further course will be made after those figures are received.

Good luck! Team moodix!