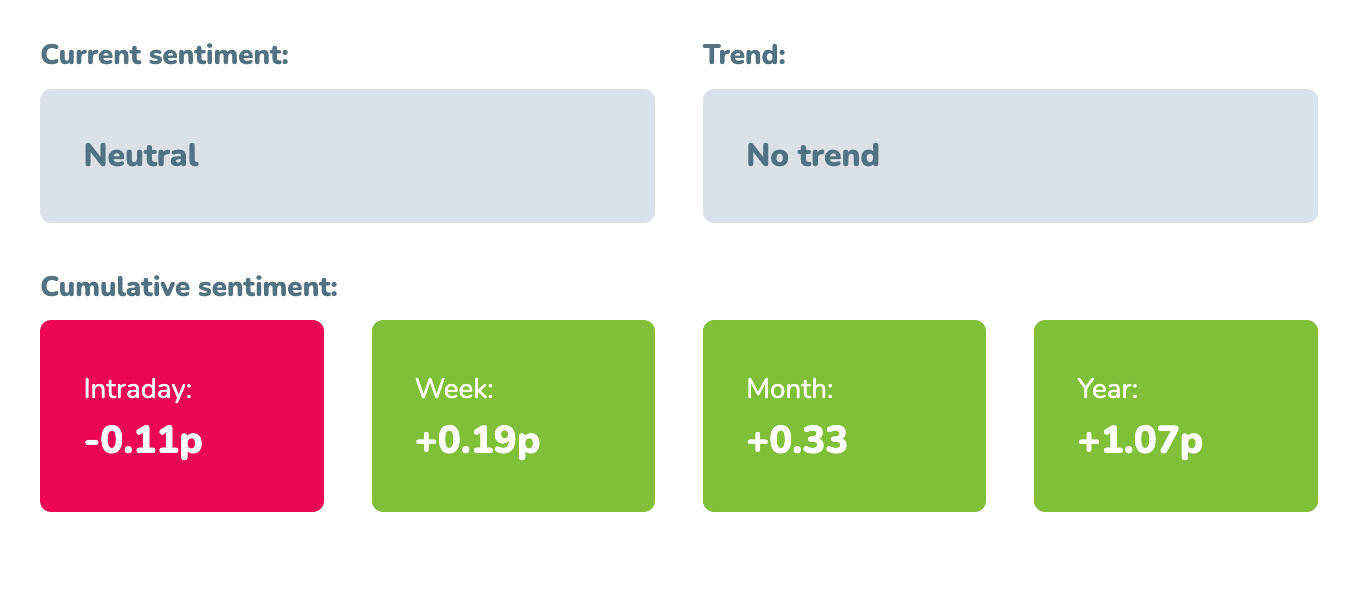

Market sentiment: Neutral – 1 days

Recap of the past week:

This past week was all about waiting for the new U.S. CPI numbers. Before we received the CPI data, the market first encountered new PPI figures, which were quite disappointing. However, Jerome Powell came to the rescue in his speech, downplaying the PPI data and reiterating the Fed’s commitment to reducing inflation and fostering economic growth. Following this, the final U.S. CPI numbers were released, showing decent results and giving the RiskOn sentiment a fresh positive boost. Despite this, the market struggled to find strength for the rest of the week, largely fending off verbal interventions from Fed officials, suggesting higher rates for longer periods. Thanks to that market sentiment indicator entered neutral zone.

Outlook for the following week:

We can call this week the week of fresh PMIs. We’ll get new numbers from the major EU and U.S. economies, with the market eagerly looking for clues about purchasing managers’ sentiments. On Wednesday, we’ll also receive the minutes from the latest FOMC meeting. But let’s go step by step:

On Monday the macro calendar is typically almost empty. There are holidays in Switzerland, Germany, and France. The main points of interest will be the PBoC rate decisions and speeches from BoE and Fed central bankers.

On Tuesday, we’ll see the RBA meeting minutes in Asia. In the EU, only Germany’s PPI will be released. During the U.S. session, Canadian CPI and more speeches from Fed officials will take the stage.

On Wednesday, the Asian session brings Japan’s trade balance and RBNZ rate decisions (expected to remain unchanged). In the EU session, we’ll get UK CPI and PPI data. During the U.S. session, there will be home sales data, a 20-year U.S. debt auction, and the highly anticipated FOMC minutes. Post-close, we will get critical earnings from Nvidia, which has the potential to shake up the entire tech sector.

Thursday – the main macro day of the week – begins in Asia with New Zealand’s retail sales and the first batch of PMI data from Australia. During the EU session, we’ll see a series of PMI figures from France, Germany, the EU, and the UK. In the U.S. session, it will mainly be about PMIs, the weekly labor market overview, home sales, and the U.S. 10-year debt auction. Before the close, Bostic from the Fed will speak.

Focus on Friday will be on Germany’s Q1 GDP update, then we’ll get UK retail sales, and a speech from the SNB chairman. In the U.S. session, we’ll get durable goods orders, a speech from Fed’s Waller, and the Michigan Consumer Index, including inflation expectations.

Long-term sentiment

Despite the positive impulse from good U.S. CPI data, market sentiment indicator closed at neutral levels. This was mainly due to comments from Fed officials, likely trying to temper the euphoric reaction to the recent CPI reading (which was good but not miraculous). Trading systems will be on hold at least until Wednesday. Sentiment is neutral, and the market needs a new catalyst for further movement. Will it be the FOMC minutes? PMI data? We’ll see!

Good luck! Team moodix!