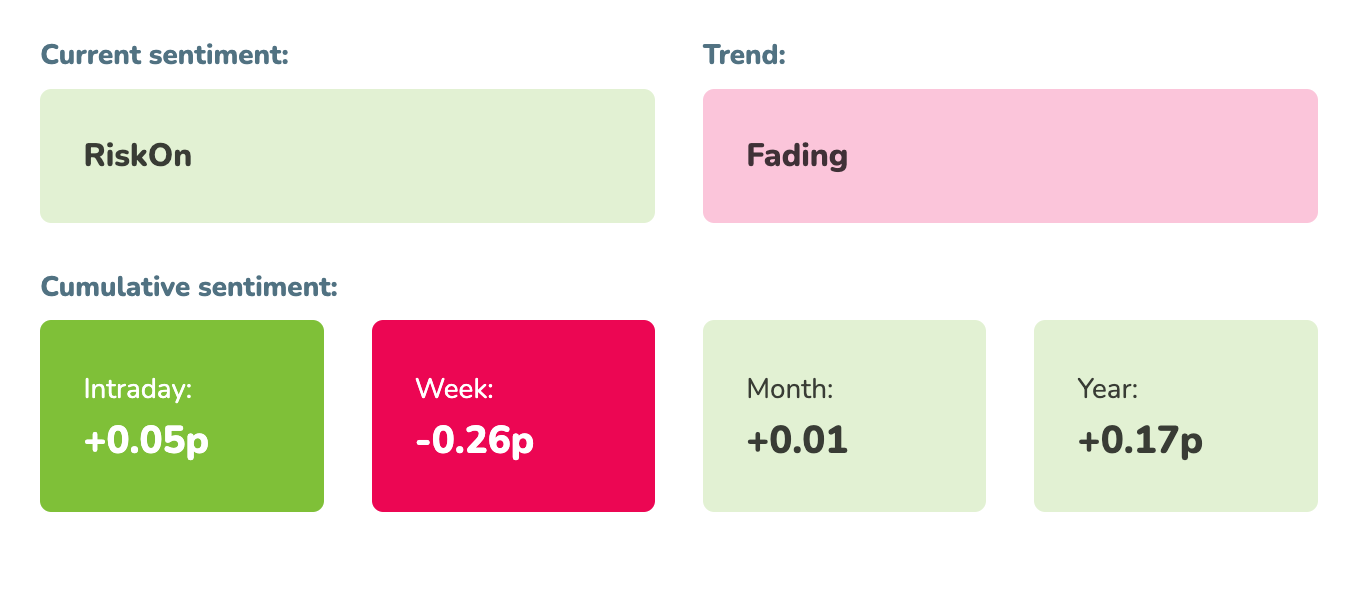

Market sentiment: RiskOn 21 days

Recap of the past week:

The week marked by yet another inflation disappointment is behind us. The highly anticipated figures for February were a disappointment again. Whether it’s the US CPI or the US PPI. One cannot say that inflation is significantly rising, but its stagnation above 3% does not provide the Fed members free hands for an early rate cut. Although the current inflation figures are “relatively bad,” the market still maintains its position and resists any deeper correction. This is mainly due to the strong growth of the tech sector providing support to other segments as well. Whatever our opinion might be, the truth is that the market is showing its strength.

Outlook for the following week:

After last week’s strong macroeconomic performance, we will continue with an even stronger one. We are awaiting interest rate decisions from most of the major central banks, including the most anticipated from the Fed, data from China, fresh CPI and PMI figures. But let’s go step by step:

On Monday, we expect main data from China, specifically retail sales and industrial production figures. A relatively strong decline is expected year-over-year for both indicators, so the expectation is more defensive. Any positive development would provide support to Asian markets.

On Tuesday, we begin in Asia with interest rate decisions from the BoJ and RBA. No substantial changes are expected here, and the subsequent press conferences will be a bit more important as usual. In the EU, we’ll got the ZEW for March. In the US session, we’ll start with Canadian CPI (due to bad data in the US last week, this will be quite closely watched, and if there was positive downward pressure, it could somewhat straighten out the inflation mood. However, an increase to 3.1% from 2.9% is expected). Then we’ll also get US housing construction market data.

The main macro day of the week is Wednesday, we start in Asia with Chinese interest rates. No change is expected (though the market would welcome it), but much could be indicated by further comments. In the EU, we await German PPI, UK CPI/PPI. In the US, we then get the main event of the week, the Fed rates. Given the development of inflation in the US, no change is expected. Again, the subsequent press conference by Jerome Powell will be most important. He’ll have to communicate the current US inflation development in some way, and it likely won’t be good news for the market.

On Thursday, we’ll receive first PMIs estimates from all the biggest economies. We start early in Asia with the Japanese/Australian PMI survey and the Australian labor market. In the EU, we gradually receive all the major PMIs (France, Germany, Italy, UK…). Then the Swiss National Bank will issue a rate update (again, the subsequent press conference will be important). Given the strength of the CHF currency and low inflation, the commentary might be slightly dovish. Then German IFO and BOE rates. The US session will bring weekly labor market overview and closely watched US PMIs. The US 10Y TIPS auction will also be important.

The macro calendar for Friday is almost empty. Since the EU summit of leaders is starting, we’ll likely get some unexpected headlines. Otherwise, just UK retail sales and then US services PMI is scheduled.

Should the Israel/Hamas agreement goes through, the situation in the Red Sea will calm down. The outlines of the agreement are on the table and should be preliminarily approved during the current week.

Long-term sentiment

Moodix market sentiment indicator indicates an upcoming potential closure of the current “very fragile” positive RiskOn sentiment. It is under pressure from bad inflation figures. Frankly, it is quite surprising that the positive sentiment has been maintained until the market close on Friday. We have been in this confusing and unclear environment already for a month. As you can see in the picture below, the current wave is lacking any substantial dynamics and trend. Given this situation, trading systems will be closed this week, and we’ll have to wait for a clarification of the situation (mainly from the Fed).

Good luck! Team moodix!